How do I start processing 2020 payroll?

Every tax year we release brand new software in line with the new budgetary requirements. Thus, to move your payroll on to a new tax year, simply download the new tax year version of Thesaurus Payroll Manager when it is available on our website (from mid December) at www.thesaurus.ie/payroll-manager/

Once downloaded, this will install separately to your previous year’s software and you will see a new Payroll Manager icon appear on your desktop. Your software for the new tax year will contain a seamless import facility to bring across your employee details from the previous tax year (please see below). In doing so, your previous year’s information will remain untouched and accessible.

As per our End User Licence Agreement, a new licence is required each tax year to continue with the software after 60 days trial use.

Importing your Company and Employees from the previous tax year

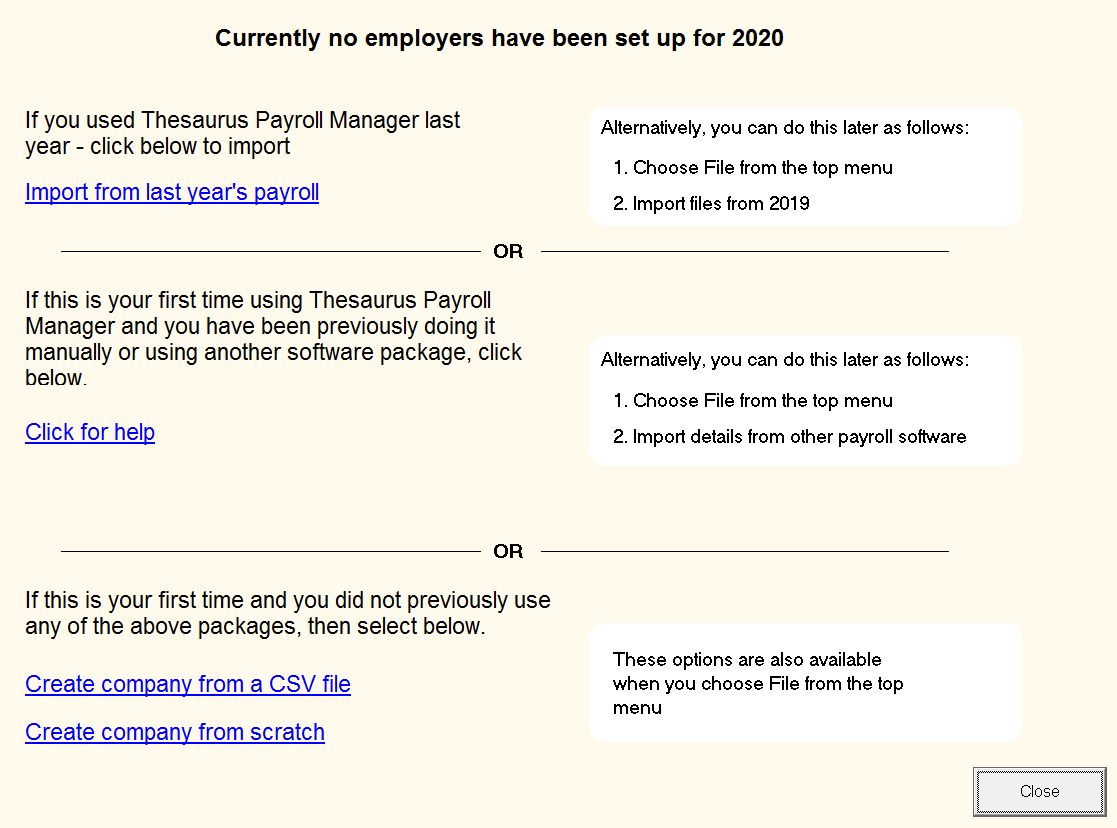

If you used Thesaurus Payroll Manager last year, you will be prompted to import your files from the previous year on entering the software for the first time.

To import both your company and employee details at the same time from the previous year:

- On the screen above click 'Import from last year's payroll' or alternatively go to File > Import files from 2019

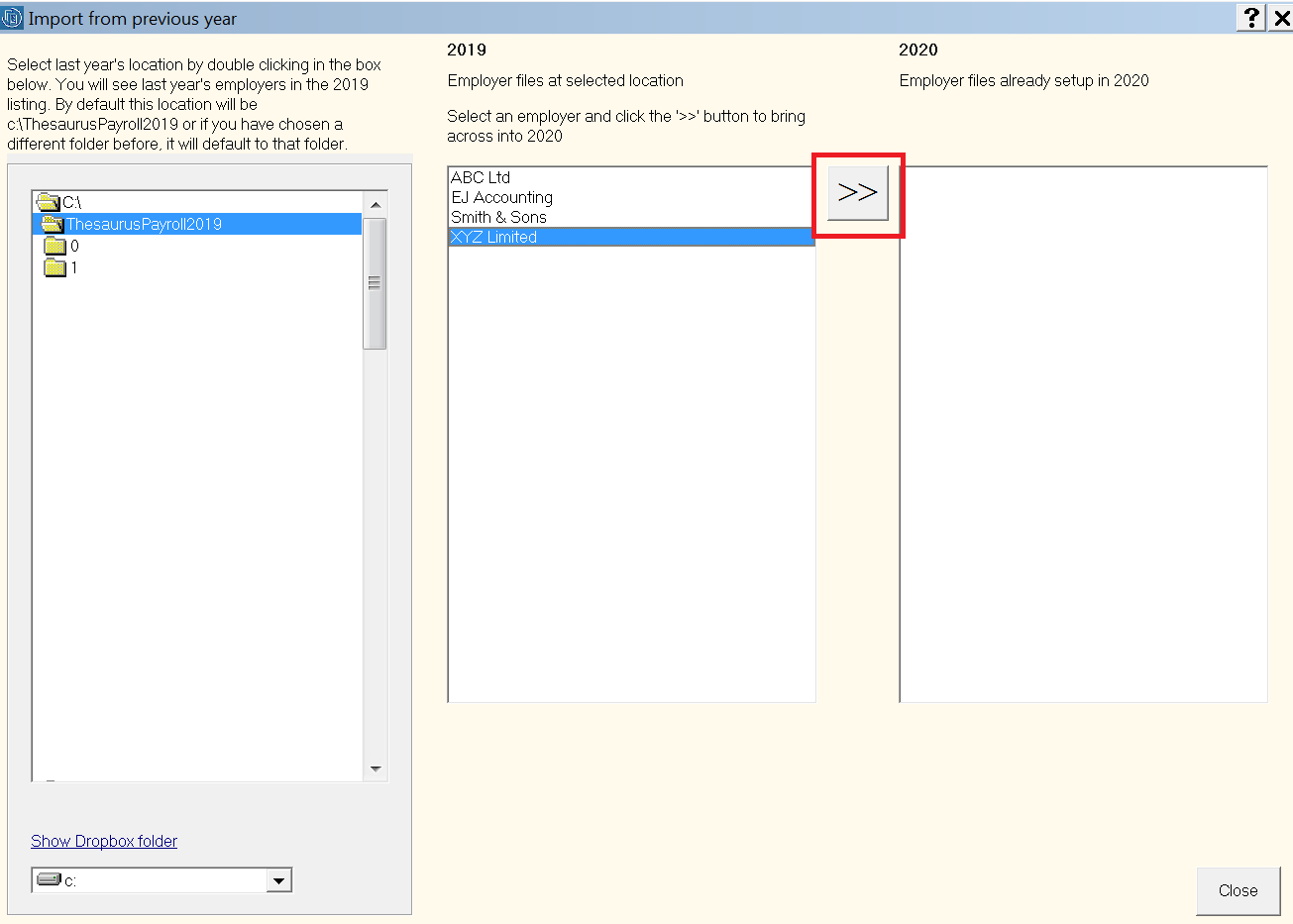

- Select last year's location of your payroll software within the left hand box. By default , this will be C:\ThesaurusPayroll2019 or if you have chosen a different folder before, it will be default to that folder.

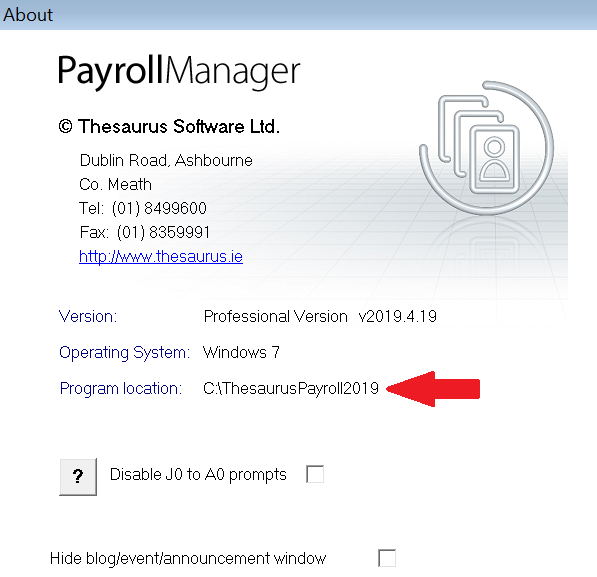

- If you are unsure where last year's software was installed to, within last year's program simply go to Help on the menu toolbar, followed by About Thesaurus Payroll. Here you will find your program location displayed on the screen:

- After browsing to the location of last year's software, all employer files at the selected location will be listed in the centre box. Simply select an employer from the listing and click the double right arrow button to bring across into the new tax year.

- If the software detects that there were employees who received no pay in the previous tax year but remained on your payroll, you will be asked if you would like to import these into the new tax year. Select Yes or No according to your requirements.

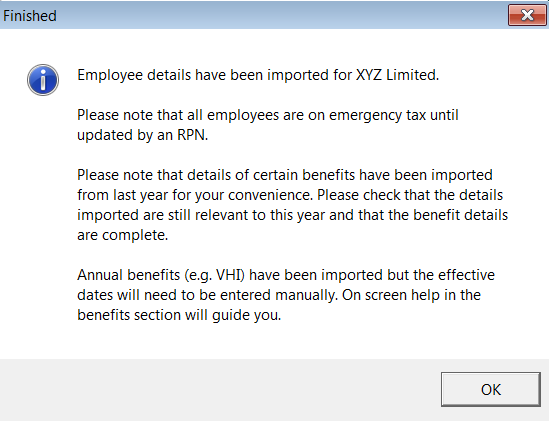

- Your company and employee details from the previous year have now been imported and a confirmation message will appear on screen to confirm this.

-

If any benefit in kind has been brought forward from the previous year, the confirmation message will bring this to your attention

-

It will also be brought to your attention that, under PAYE Modernisation, all employees imported will be placed on emergency tax until a Revenue Payroll Notification is retrieved for them.

- If you have more than one company to import, simply select the next employer from the central box and repeat the process

-

Once you have imported the companies you need, simply go to File > Open Company to access your companies

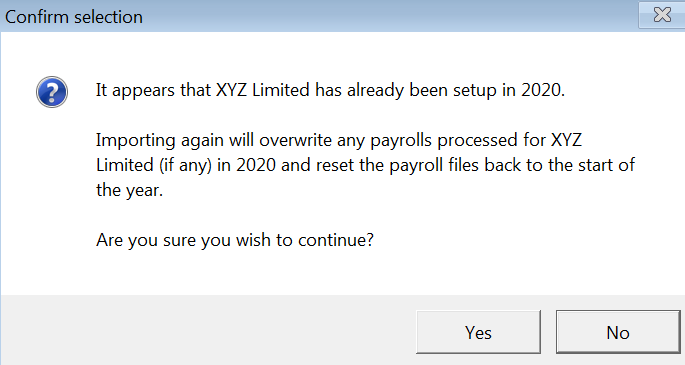

IMPORTANT: if a user attempts to import a company that has already been imported, a warning prompt will appear to inform the user of this. Importing a company again will overwrite any payroll processed for that company and will reset the payroll files back to the start of the year. If the user does not wish to do this, they must select 'No' to cancel the process.

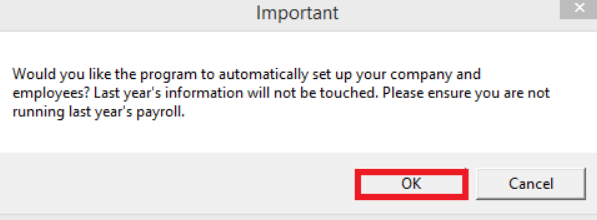

Please note: if you use the standard version of Thesaurus Payroll Manager and the software is installed to the default directory you will be offered an automated import. Select 'OK' to proceed with the automated import.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.