Cessation of TWSS - spreading Benefit in Kind over remainder of the year

With the cessation of the Temporary Wage Subsidy Scheme (TWSS), any employee who was placed on TWSS and as a result had their benefit in kind suspended, will now have their BIK re-instated.

By default, Thesaurus Payroll Manager will charge any outstanding BIK to date in the first pay period which falls after an employee is taken off TWSS.

Should this have a significant effect on the employee's payslip, resulting in a very low or negative take-home pay, you may wish to spread out the outstanding balance over the remainder of the year instead.

This can be done in two ways:

Option 1 - using the 'One-Off Benefits' option

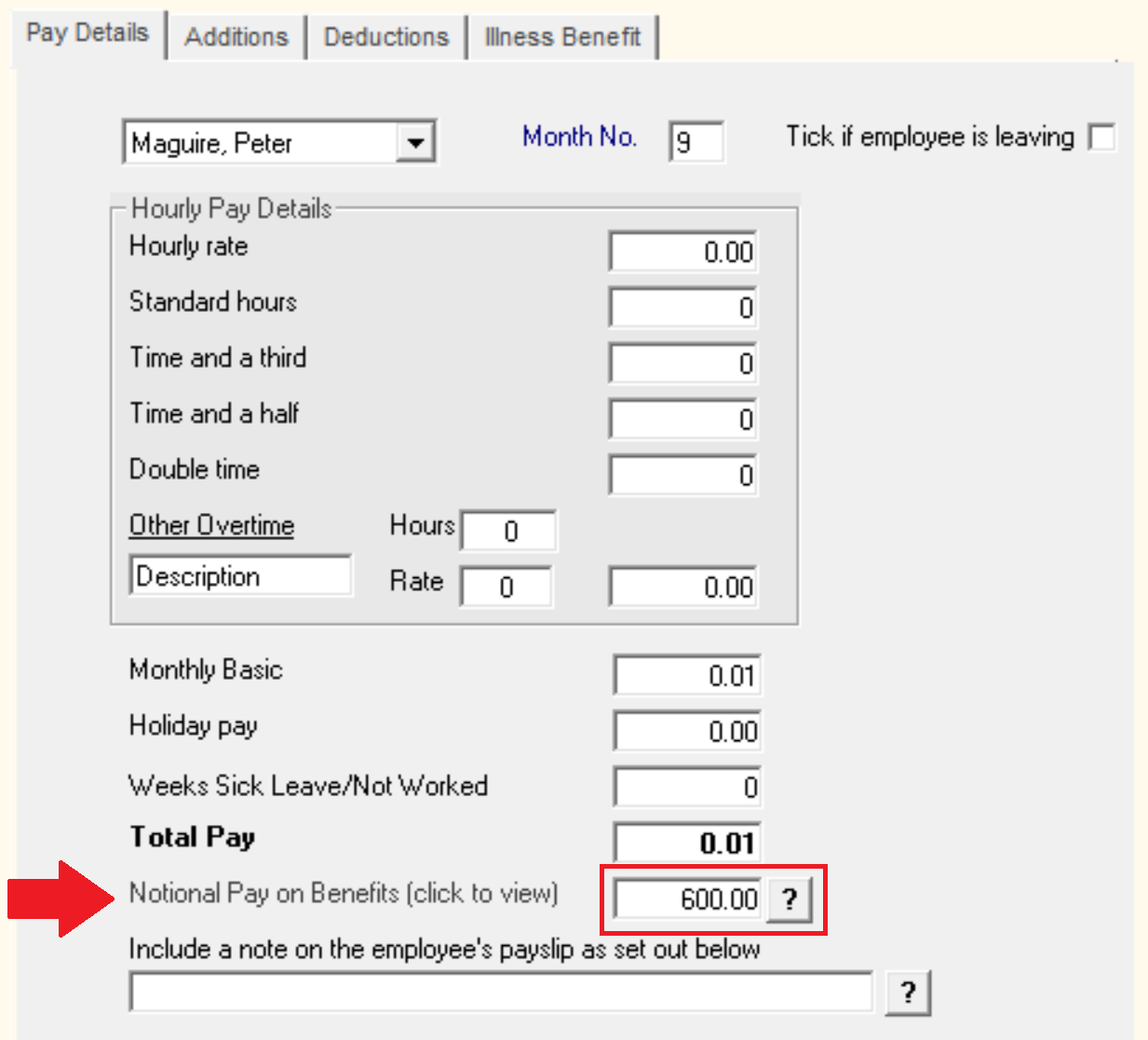

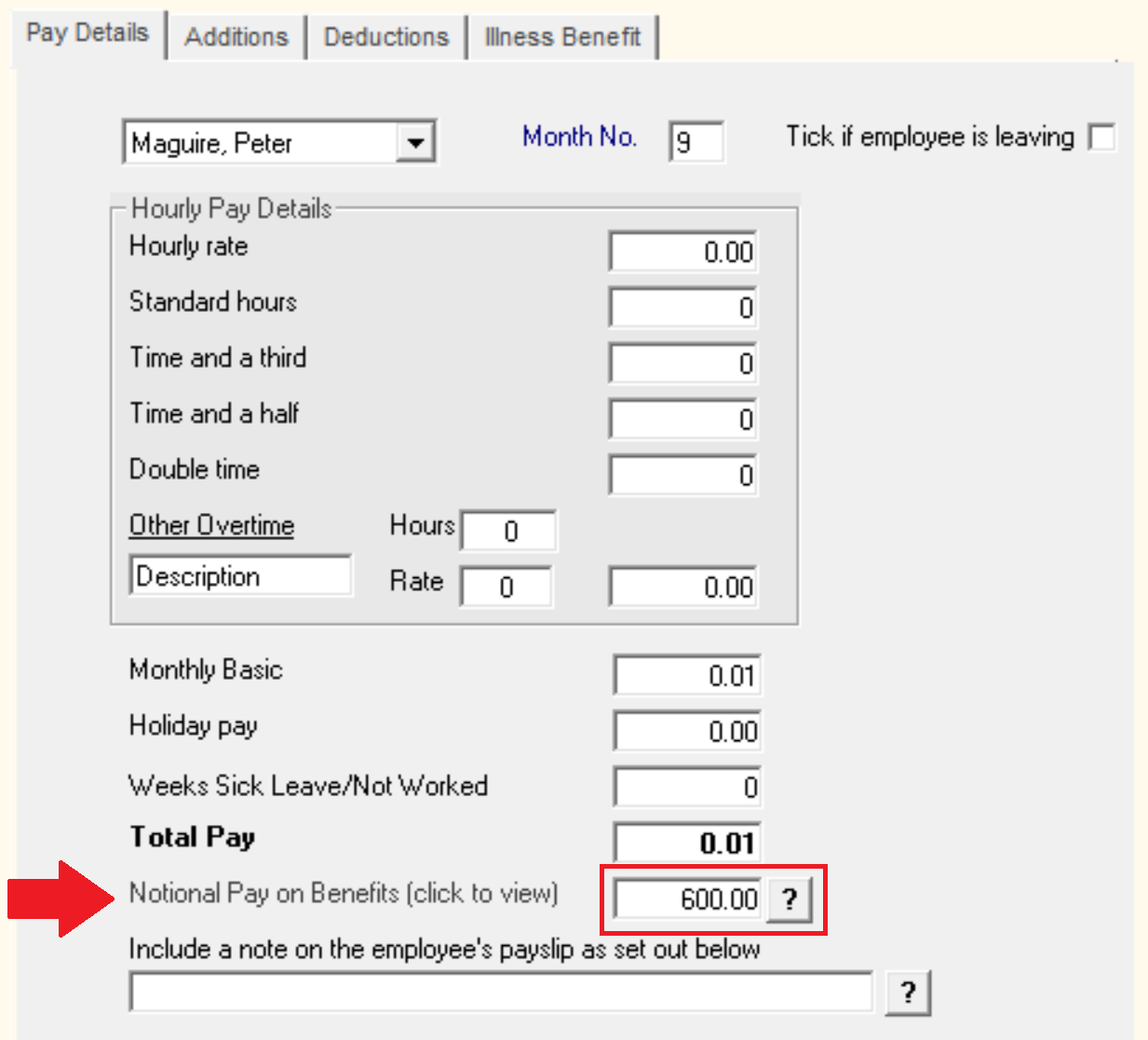

1) Firstly, ascertain the amount of BIK currently outstanding to date. This can be quickly checked via the employee's current open payslip in Periodic Input:

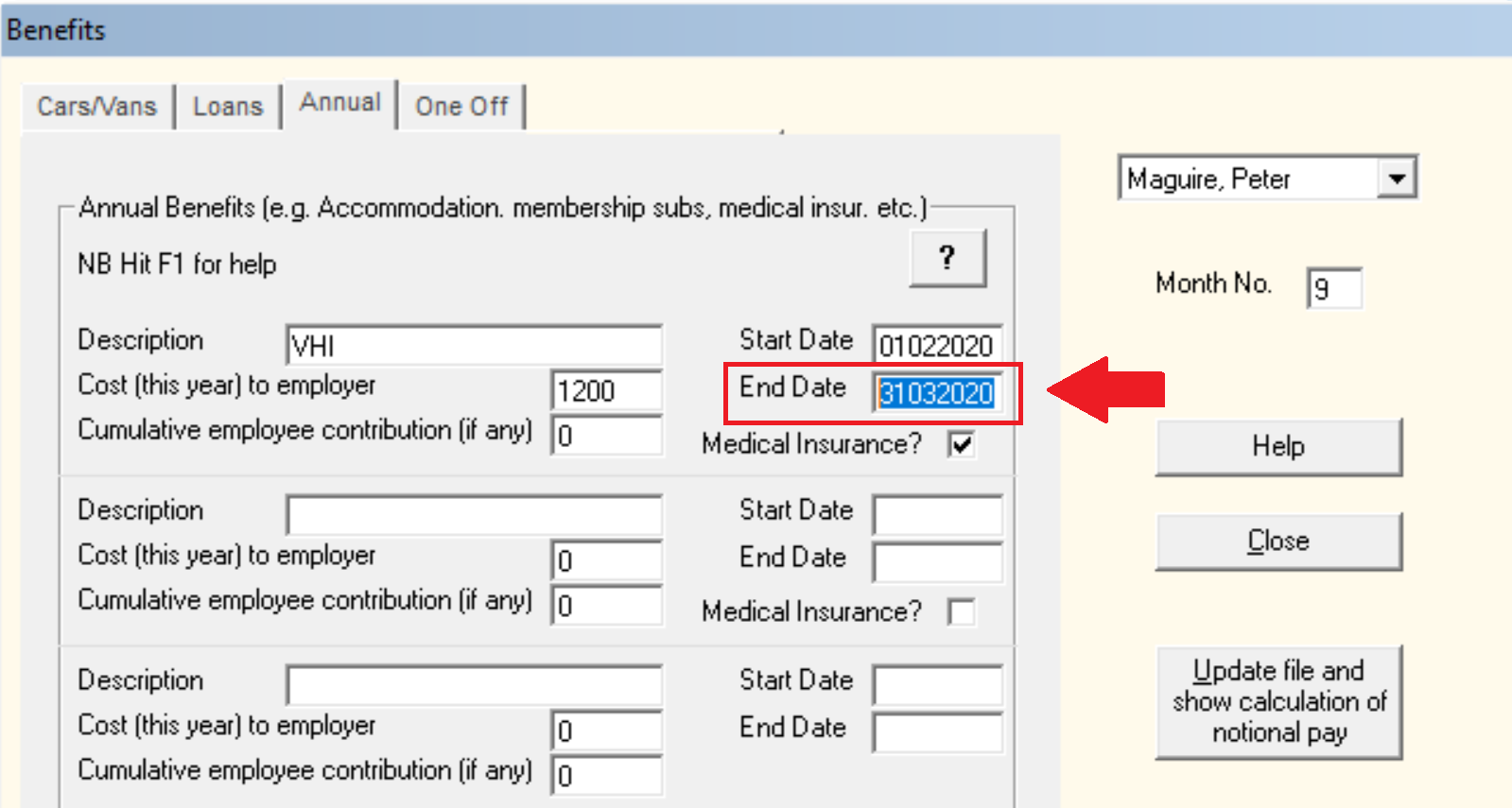

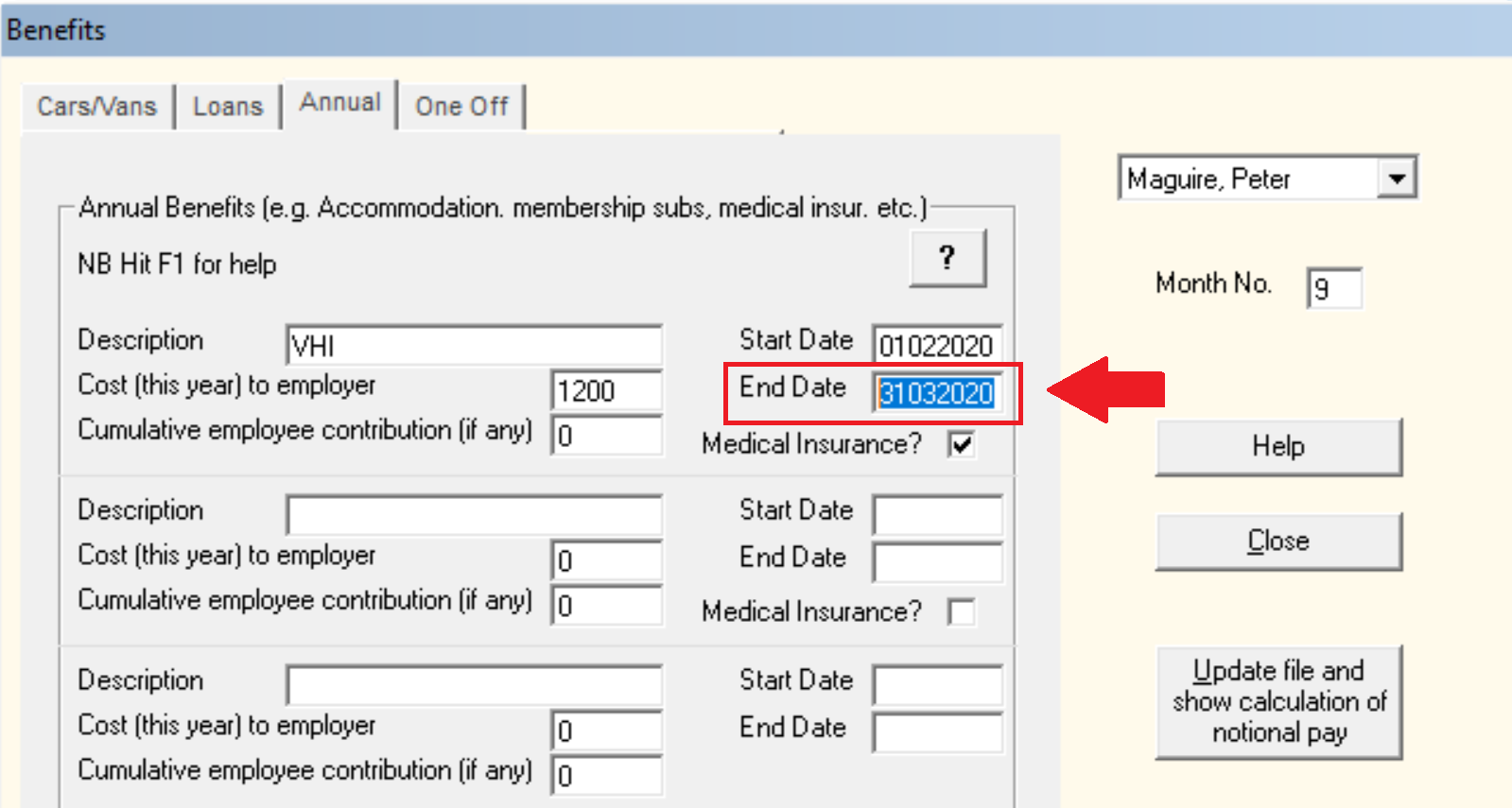

2) Next, enter an end date against the employee's original BIK record, in line with when the employee was last charged benefit in kind.

Click 'Update File and show calculation of notional pay' once entered.

3) Next, calculate the overall amount of BIK still outstanding for the remainder of the year.

Example: using the above screenshots, the employee has an outstanding balance of €600 at the end of September and will also have €100 per month in BIK for October to December. Therefore the overall total of BIK still outstanding is €900.

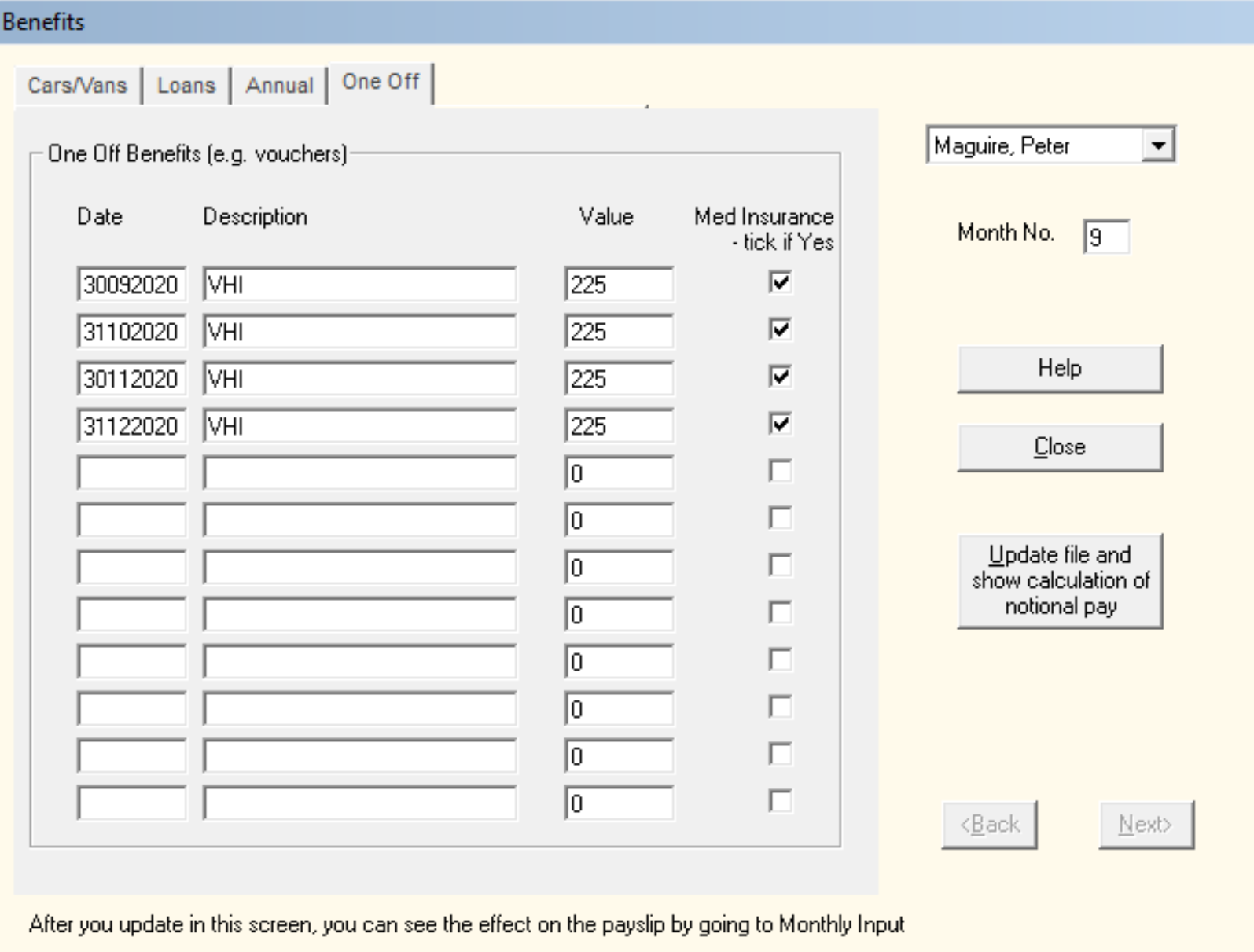

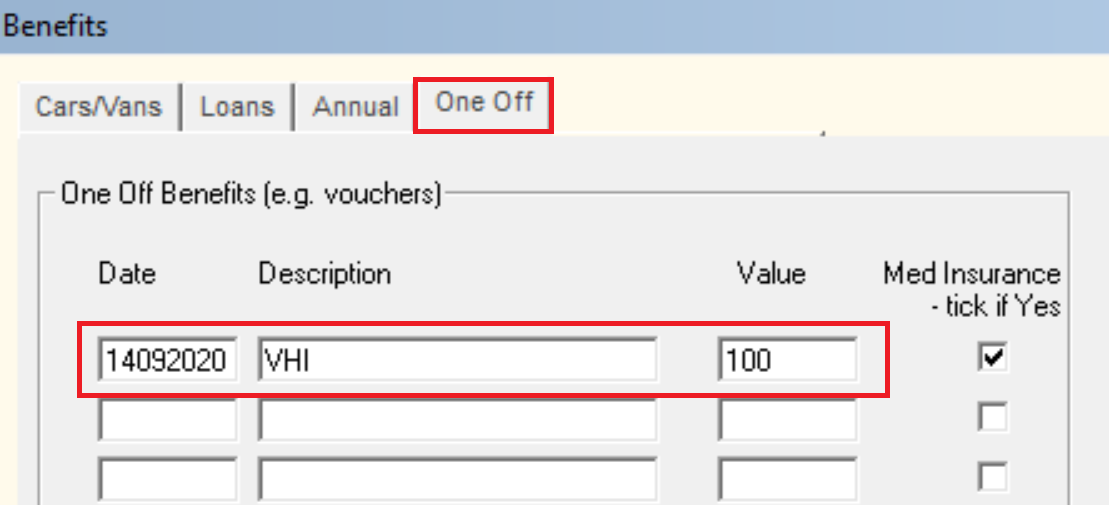

4) Go to Employees > Update Employee Benefits > choose the employee > select One-Off

Now evenly spread the total outstanding BIK over the remaining pay periods and 'Update File and show calculation of notional pay' when complete:

The software will now evenly spread out the remaining BIK over the remainder of the year, as per your entries.

Important Note:

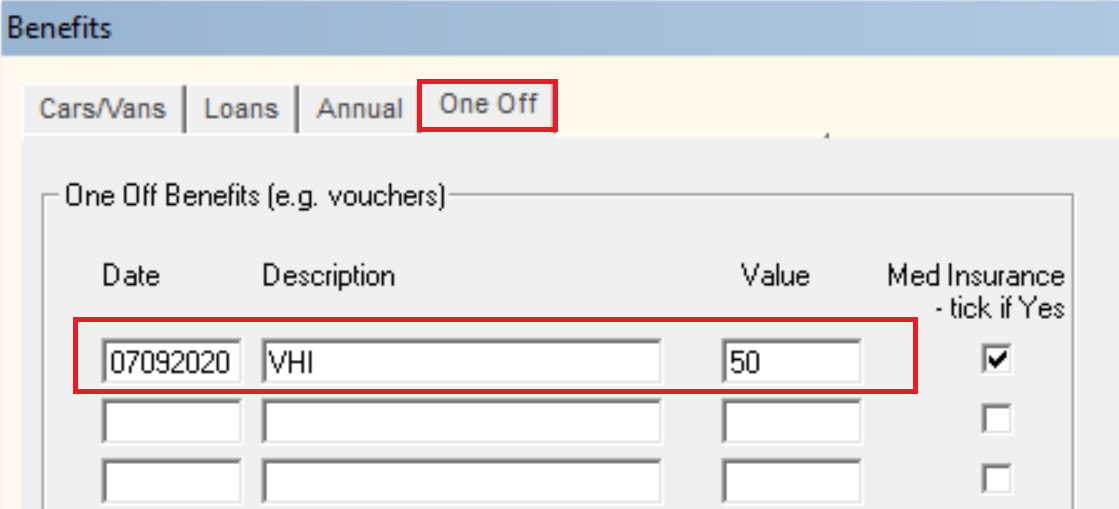

Where there aren't enough one-off benefit fields for the number of pay periods you have remaining (e.g. if you operate a weekly payroll), a manual increment will need to be performed each pay period until the end of the year, as per the example below. In this instance, you may wish to consider Option 2.

Option 2 - using the 'Annual Benefits' option

1) Firstly, ascertain the amount of BIK currently outstanding to date. This can be quickly checked via the employee's current open payslip in Periodic Input:

2) Next, enter an end date against the employee's original BIK record, in line with when the employee was last charged benefit in kind.

Click 'Update File and show calculation of notional pay' once entered.

3) Next, calculate the overall amount of BIK still outstanding for the remainder of the year.

Example: using the above screenshots, employee has an outstanding balance of €600 at the end of September and will also have €100 per month in BIK for October to December. Therefore the overall total of BIK still outstanding is €900.

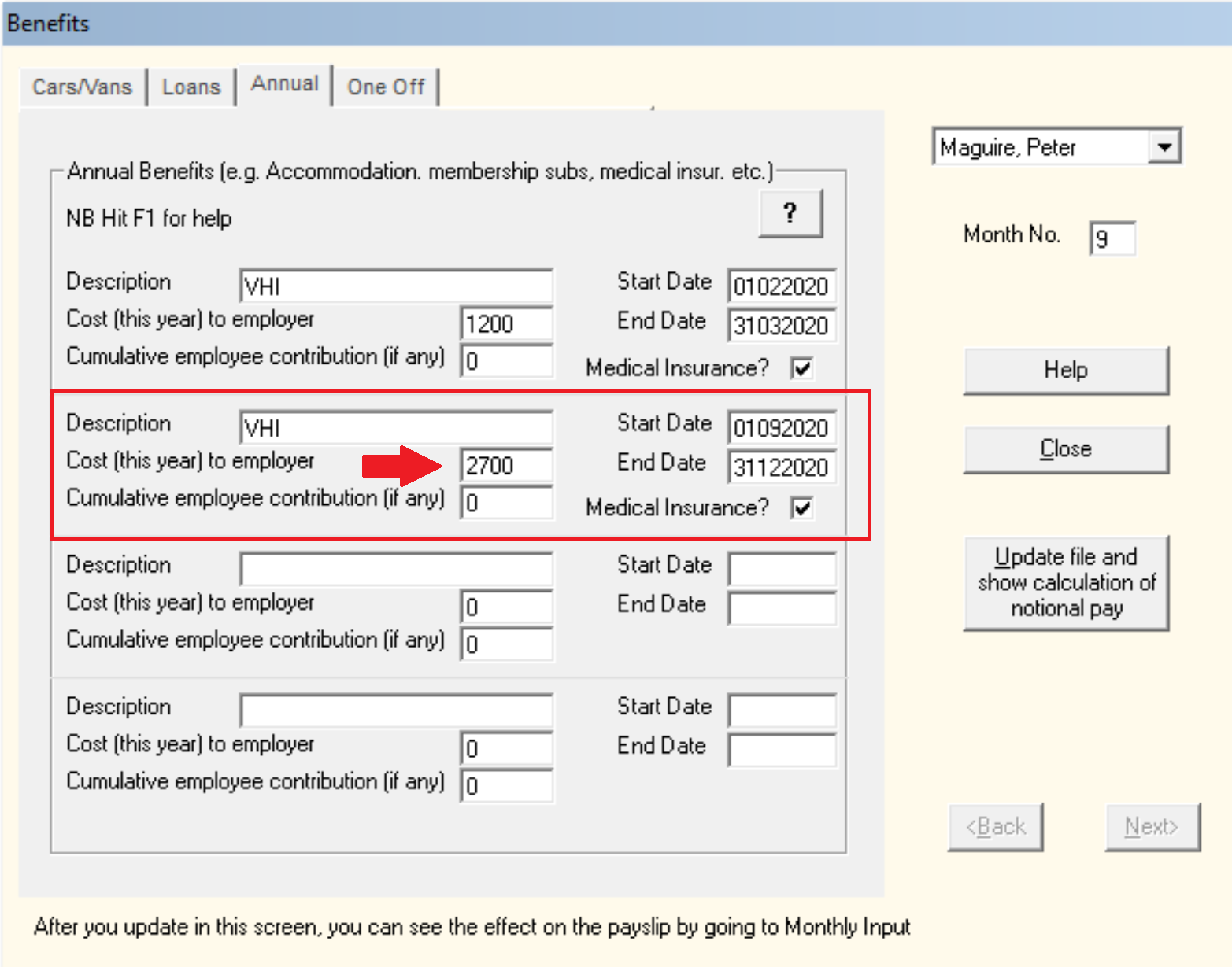

4) Go to Employees > Update Employee Benefits > choose the employee > select Annual

a) In the next available section, enter a Description

b) Enter a Start Date in line with the employee's current open pay period

c) Enter an End Date in line with the end of the year

d) For the Cost to Employer, you must now annualise the figure ascertained in Step 3 above.

Using the example above, to annualise the €900 due over the remaining 4 monthly pay periods:

- €900 / 4 months x 12 months = €2,700

Enter this in the field provided:

The software will now evenly spread out the remaining BIK over the remainder of the year, as per your entries.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.