Operating EWSS in Thesaurus Payroll Manager

The Employment Wage Subsidy Scheme (EWSS) has replaced the Temporary Wage Subsidy Scheme (TWSS) from September 1st 2020.

Comprehensive Revenue guidance has been published with regard to the operation of the Employment Wage Subsidy Scheme.

It is recommended that you fully familiarise yourself with the Scheme Guidelines.

Employers must also determine that they meet the Scheme's qualifying criteria. If so, employers will then be required to register for the EWSS via ROS before they can avail of the Scheme.

Further information on the qualifying criteria can be found on the Revenue website .

In addition, Revenue have published guidelines on eligibility for the Employment Wage Subsidy Scheme from 1 July 2021 which can be accessed here

Important note

Employers must undertake a review of their eligibility for the scheme on the last day of every month (other than the final month of the scheme) to be satisfied whether they continue to meet the eligibility criteria and to take the necessary action of withdrawing from the scheme where they do not.

To assist employers in ensuring continued eligibility for the scheme, from 30 June 2021, all employers are required to complete and submit through ROS an online monthly EWSS Eligibility Review Form. Comprehensive guidance regarding this requirement can be found in Revenue's published guidelines which can be accessed here.

An overview of the Scheme is available here .

EWSS & Thesaurus Payroll Manager

Although the EWSS is a subsidy payable to employers only and will not impact employee payslips, the scheme must still be administered through the payroll.

The steps to complete within the software are provided below.

Step 1 - Enter your Registration Date for EWSS

Eligible employers will be required to register for the new EWSS scheme via ROS.

Once registered and to start claiming EWSS for employees, employers must use their periodic payroll submission (PSR) to notify Revenue of the employees they wish to claim EWSS for (see Step 2 below).

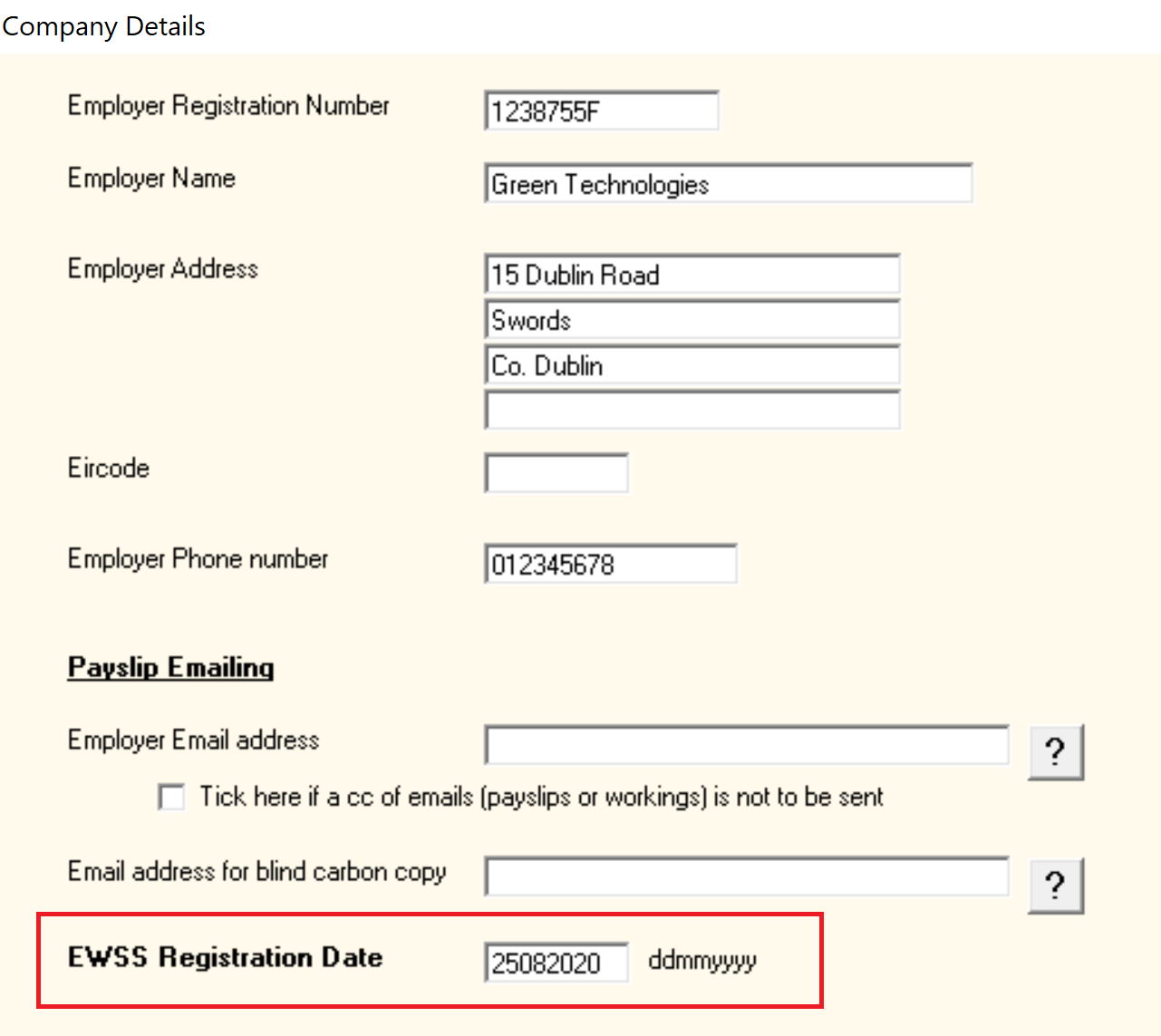

In order for the PSR in Thesaurus Payroll Manager to include an EWSS marker for an eligible employee, you must first enter your EWSS registration date within the software. This is a once-off exercise.

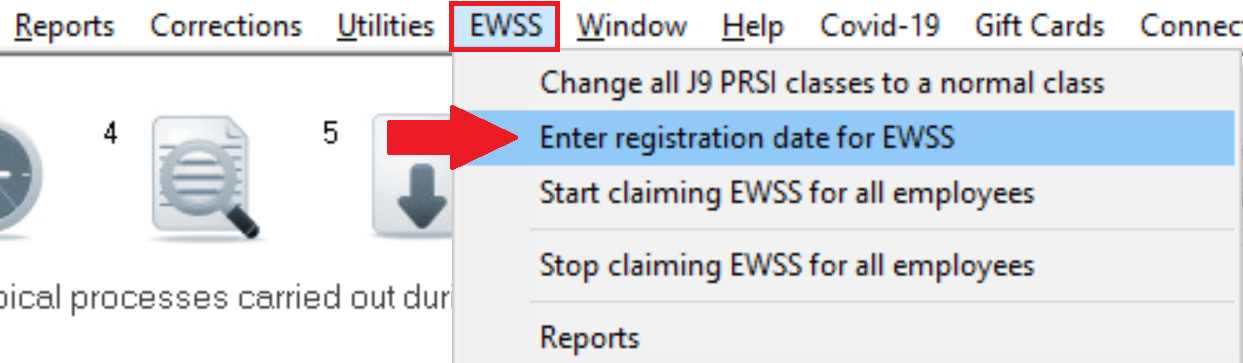

- To do this, go to EWSS > Enter registration date for EWSS:

- Enter your EWSS registration date in the field provided and click Save:

Important note:

- Should an EWSS registration date not be entered in the software or where the registration date entered falls after your pay date, your PSR will not inform Revenue of eligible employees you wish to claim for and in turn no EWSS will be claimed.

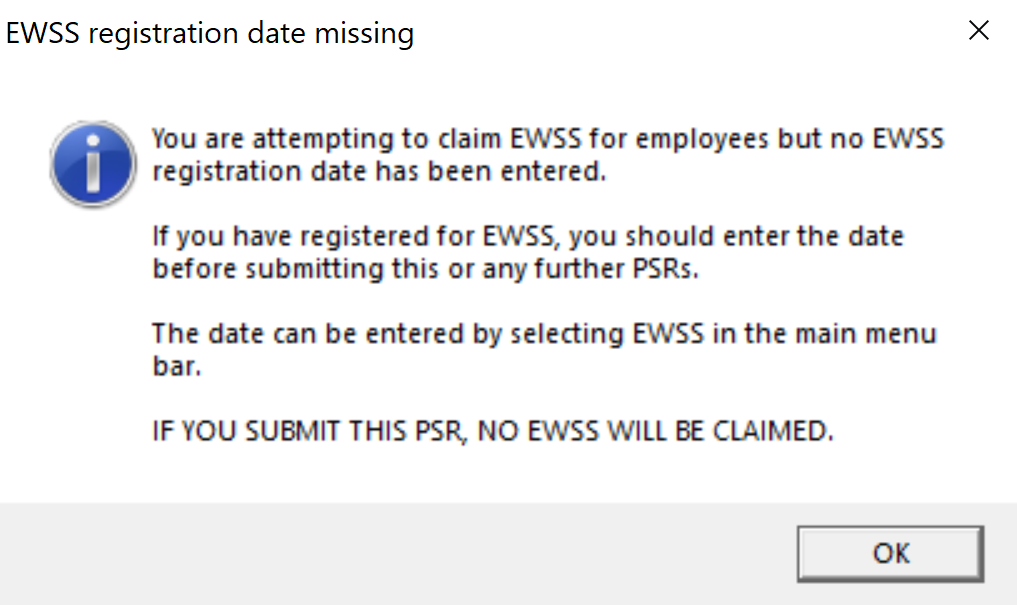

- Where an EWSS registration date is not detected, the following warning message will be given at the time of submitting your PSR:

Step 2 - Start claiming EWSS for Eligible Employees

Once you have registered for EWSS and have entered your registration date in the software, you are now ready to instruct Thesaurus Payroll Manager which employees you wish to claim EWSS for. This instruction will place an EWSS marker on the payroll submission for each applicable employee in order to notify Revenue which employees you wish to claim EWSS for.

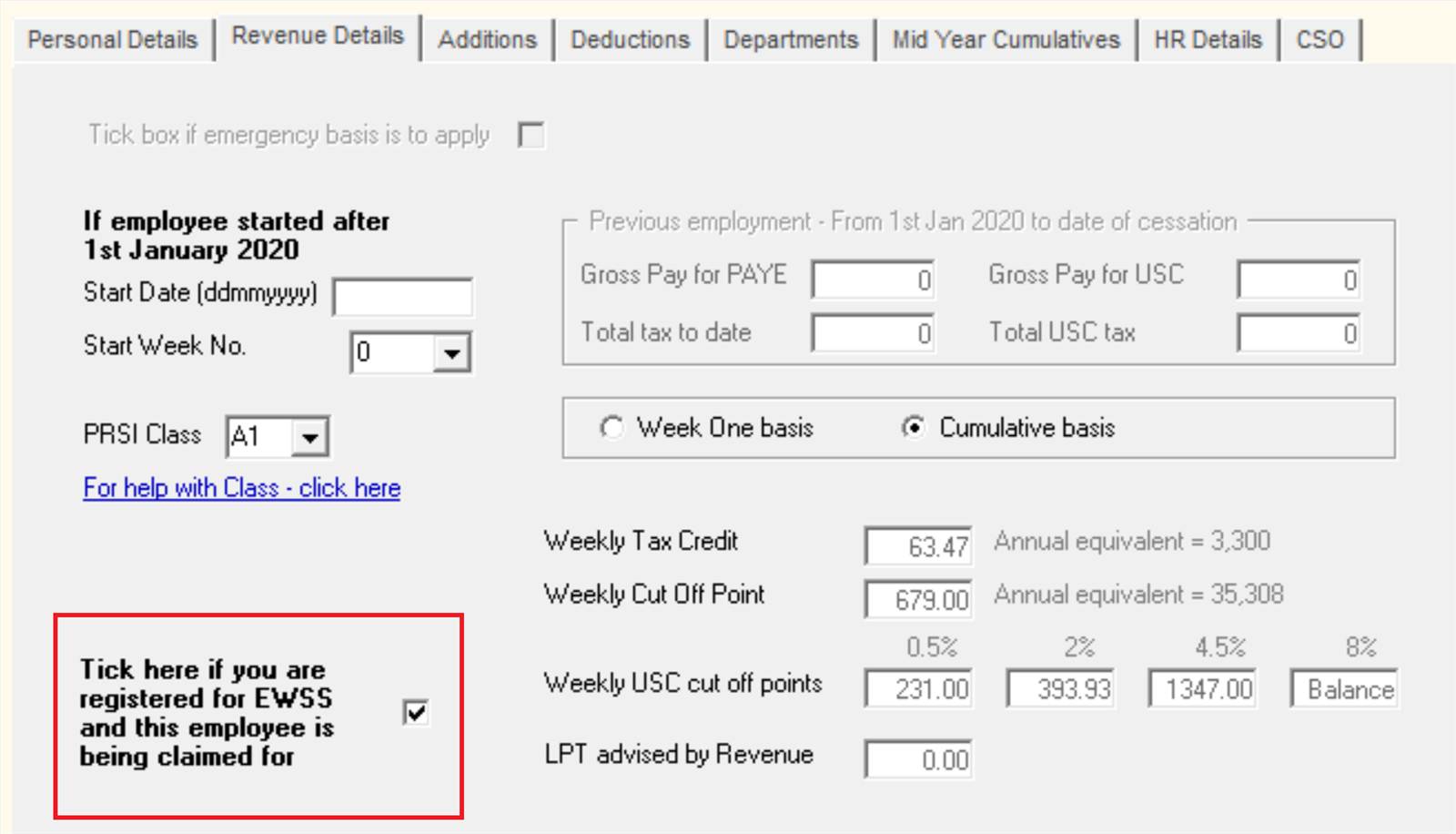

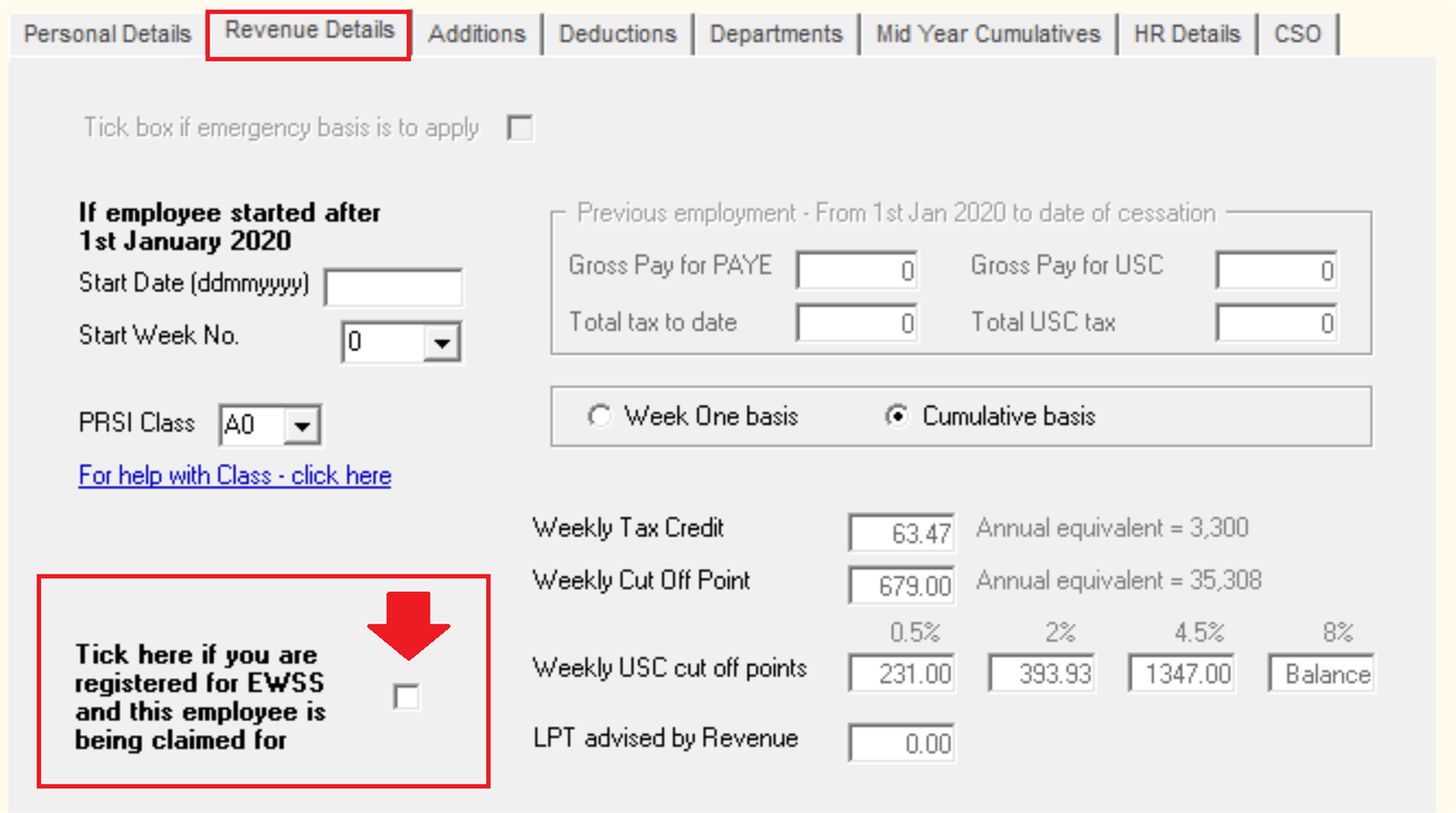

a) This can be done on an individual basis by accessing an eligible employee's record within 'Add/Amend Employees'.

- Within 'Revenue Details', tick to indicate that 'you are registered for EWSS and this employee is being claimed for'

- Click 'Update'

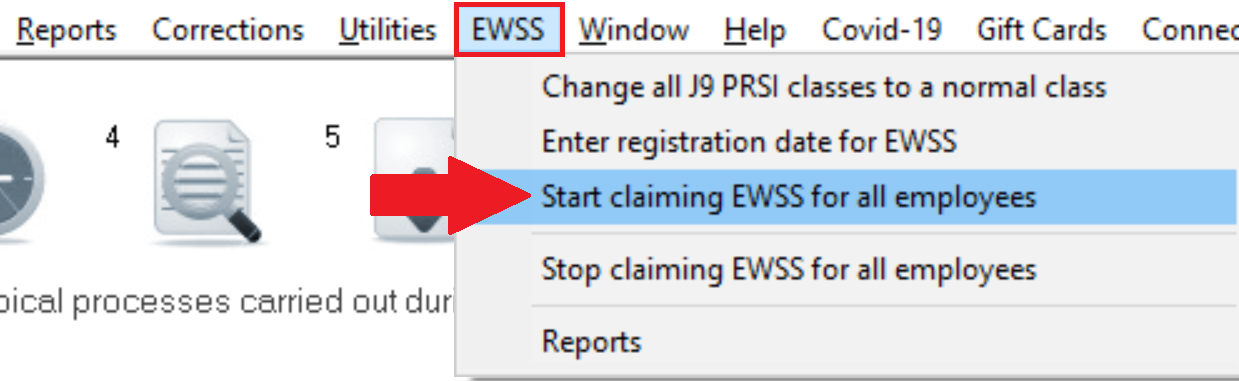

b) Alternatively, a utility is available within the EWSS menu to simultaneously set the EWSS marker for all employees on your selected pay frequency:

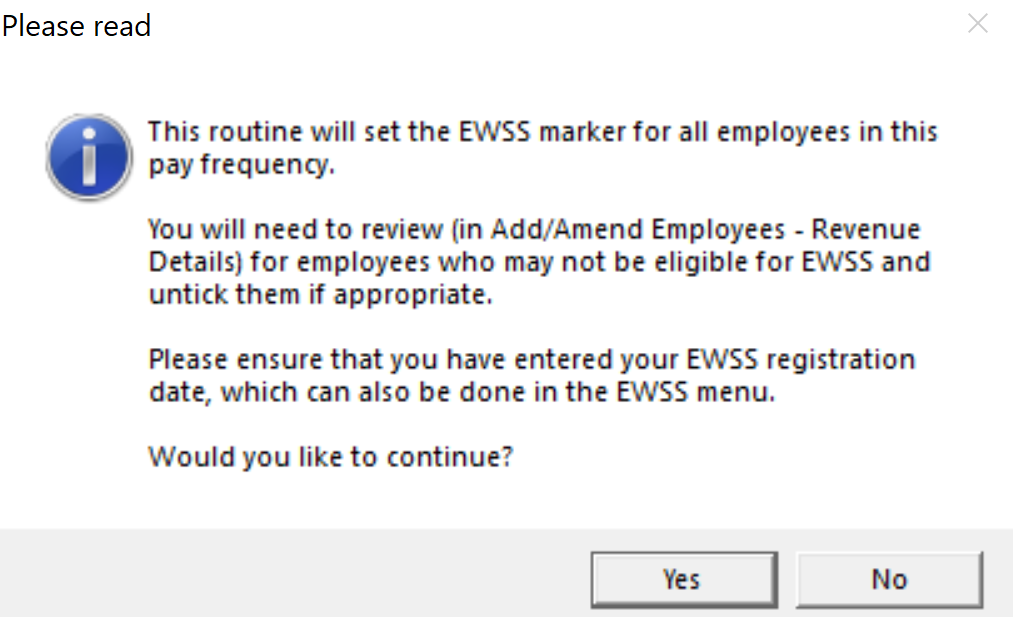

Important Note

When using this utility, the following message prompt will advise you to subsequently review any employees afterwards within Add/Amend Employees who may not be eligible for EWSS:

Where you are aware that an employee isn't eligible for EWSS, simply access their employee record within Add/Amend Employees and untick the EWSS marker within their Revenue Details utility, followed by 'Update':

Step 3 - Process your Payroll

After performing the above steps, you are now ready to process your payroll.

Under EWSS, employers are required to pay the employee as normal, calculating income tax, employee PRSI and USC in the normal manner.

On finalising each pay run, your associated payroll submission (PSR) will notify Revenue of the employees you wish to claim EWSS for. Submit this to Revenue in the normal manner.

On receipt of your payroll submission, Revenue will then determine the applicable subsidy amount payable.

Important Notes to the above:

- EWSS is a subsidy paid to the employer only and therefore there is no requirement to show EWSS on employee payslips.

- EWSS will also not show in an employee's myAccount.

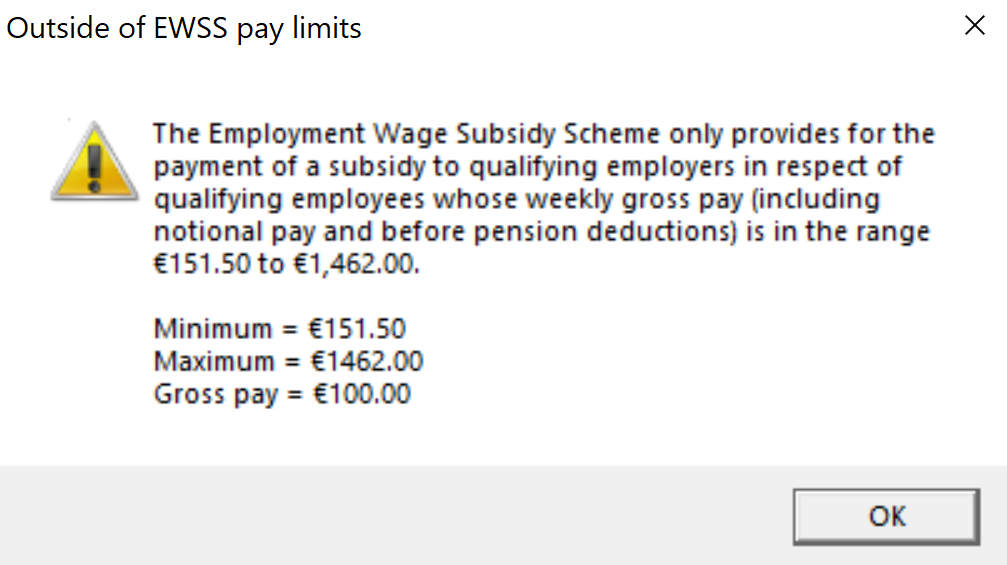

- When processing your payroll, the software is programmed to take into account any lower and upper EWSS pay limits.

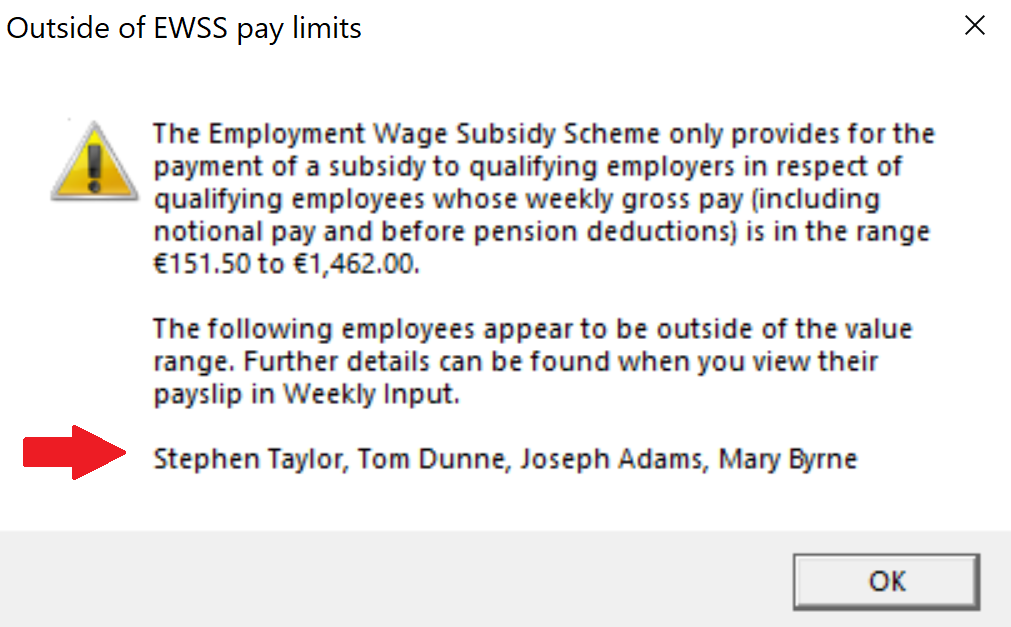

Where an employee's gross pay amount is outside of the limits and they have been marked as being an eligible employee for EWSS, the EWSS marker will not be included on the associated payroll submission for that employee.

(Gross pay includes notional pay and is before any deductions for pension, salary sacrifice etc.)

Whilst in Weekly/Monthly/Fortnightly Input (Process icon 3), where it is detected that the employee's gross pay is outside the limits, this will be brought to your attention when clicking 'Update File':

Likewise, the Payroll Preview (Process icon 4) will also prompt you where employees' gross pay amounts are outside any EWSS pay limits:

4. Up until the end of February 2022, a 0.5% rate of employer PRSI applies for employments that are eligible for the subsidy.

Employer PRSI however must be calculated as normal via payroll e.g. on PRSI class A1. Revenue will subsequently calculate a PRSI credit by calculating the difference between the employee's rate reported via the payroll submission and the 0.5%.

This credit will then show on the Statement of Account within ROS and reduce the employer’s liability to Revenue.

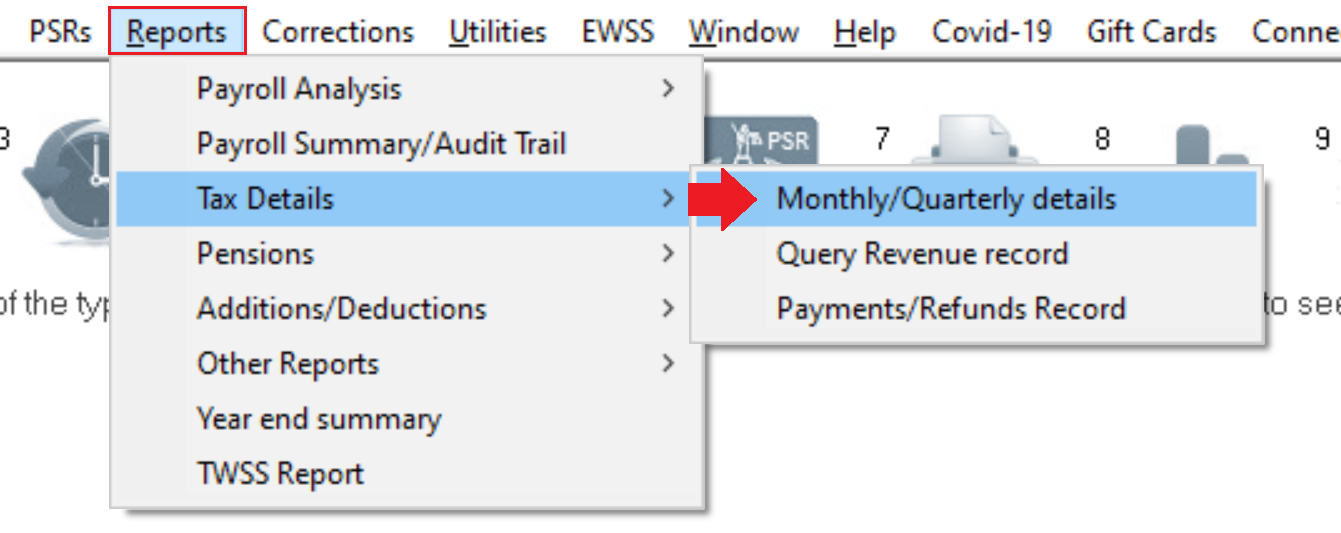

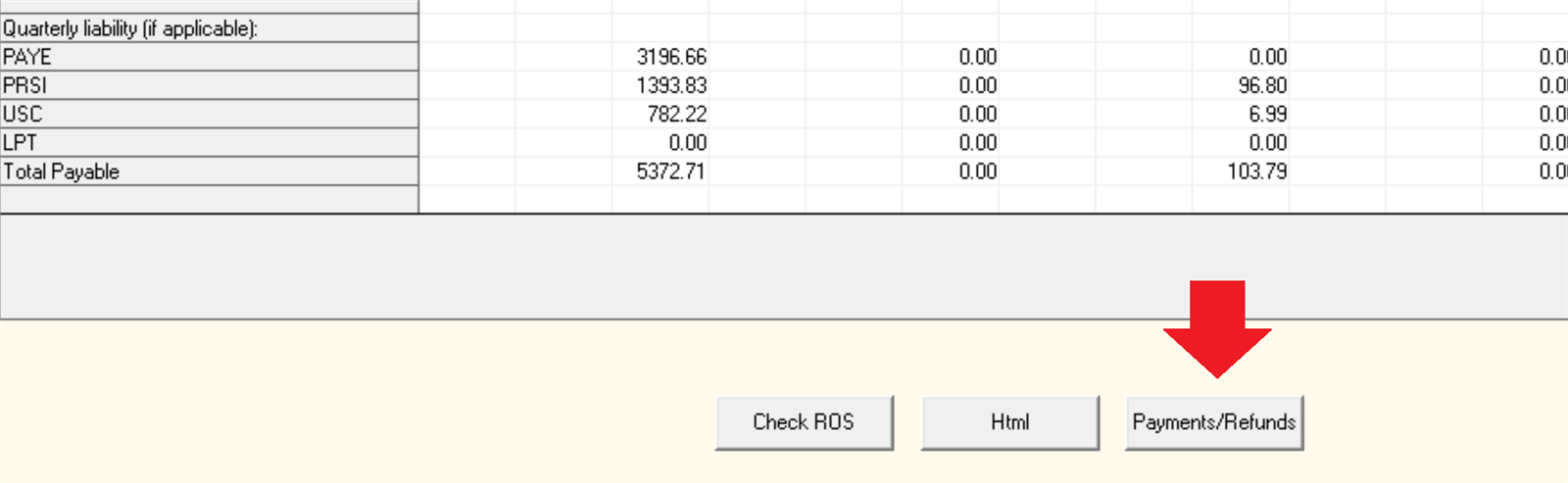

On confirmation of the PRSI Credit, users may wish to balance their Tax Details report by entering the amount credited to them:

Step 4 - Monitor your EWSS Eligibility

Employers must review their eligibility status on the last day of every month to ensure they continue to meet the eligibility criteria.

Where you no longer qualify, you should de-register for EWSS with effect from the following day (1st of the month).

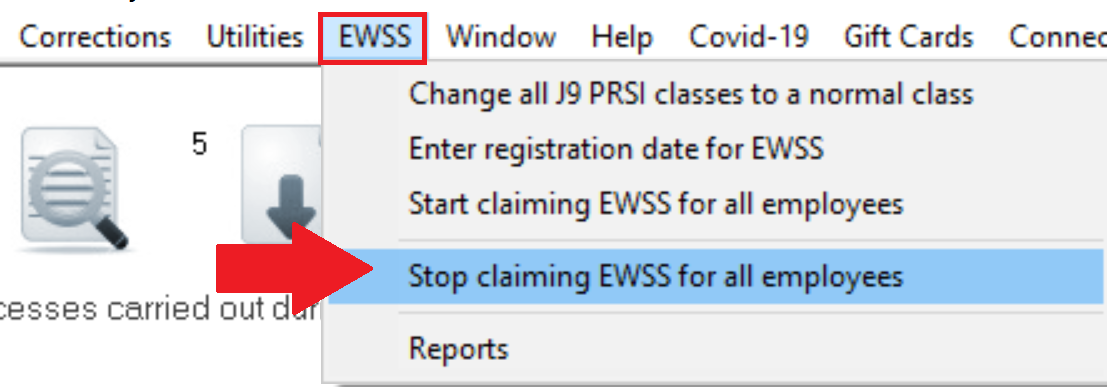

In this instance, you must also instruct the software that you wish to stop claiming EWSS for your employees.

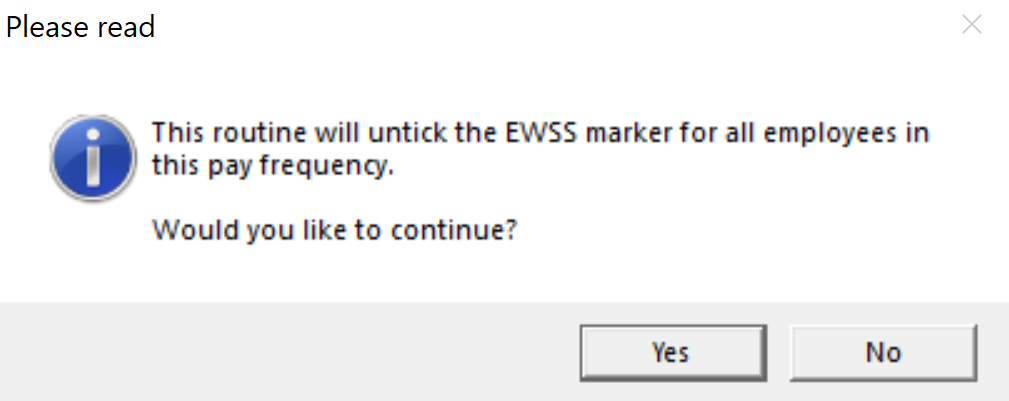

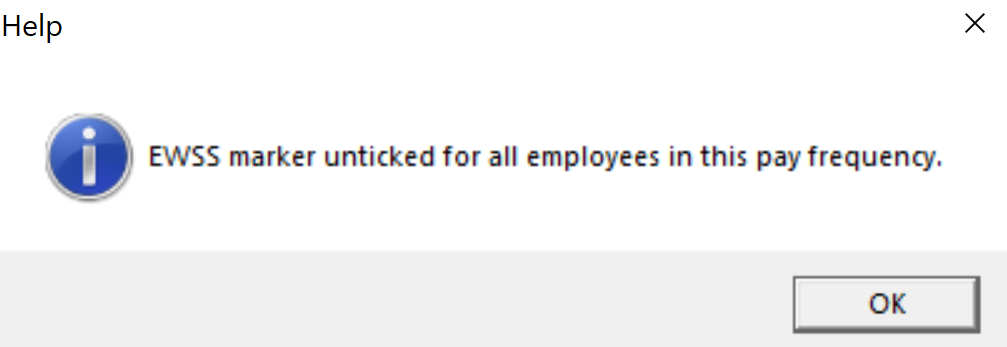

To do this, simply go to EWSS > Stop claiming EWSS for all employees:

This routine will remove the EWSS marker for all your employees on your chosen pay frequency, so that their EWSS eligibility will no longer be reported through the payroll submission. Click 'Yes' to complete the action.

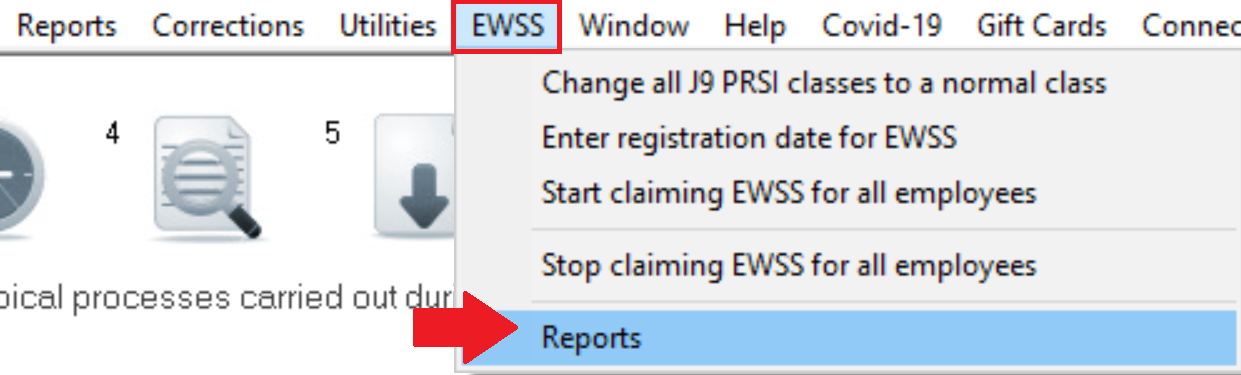

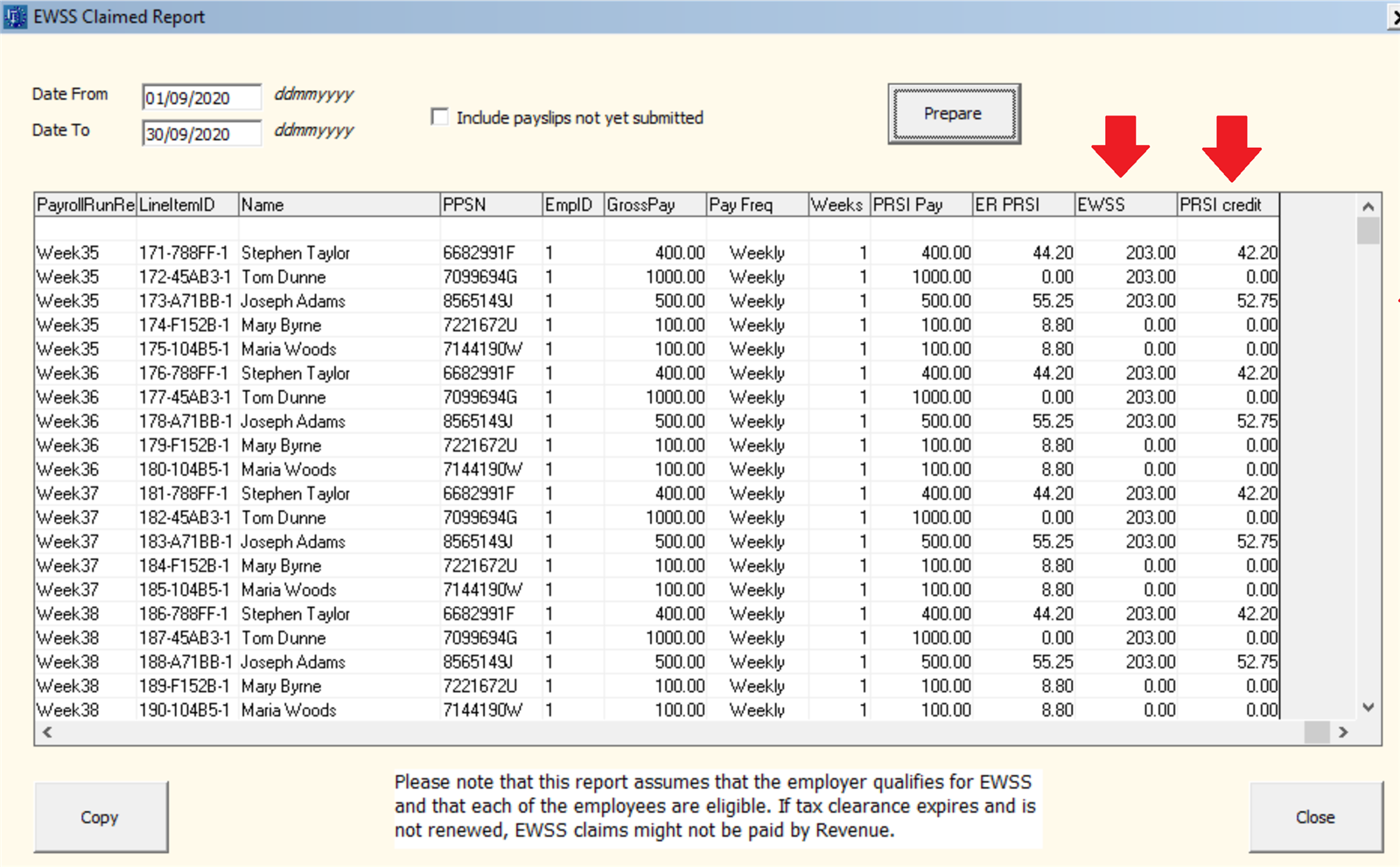

Reporting

An EWSS Report is provided under the EWSS menu in order for you to review expected EWSS subsidy amounts, as well as PRSI credits.

Please note:

This report assumes that the employer qualifies for EWSS and that each of the employees are eligible. If tax clearance expires and is not renewed, EWSS claims might not be paid by Revenue.

This report can be copied for export into Excel.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.