EWSS - 'Other Payments' Marker as advised by Revenue

Published Revenue guidance is advising employers of the following with regard to the operation of the EWSS through your payroll software:

To indicate that a subsidy is being requested for an eligible employee, employers:

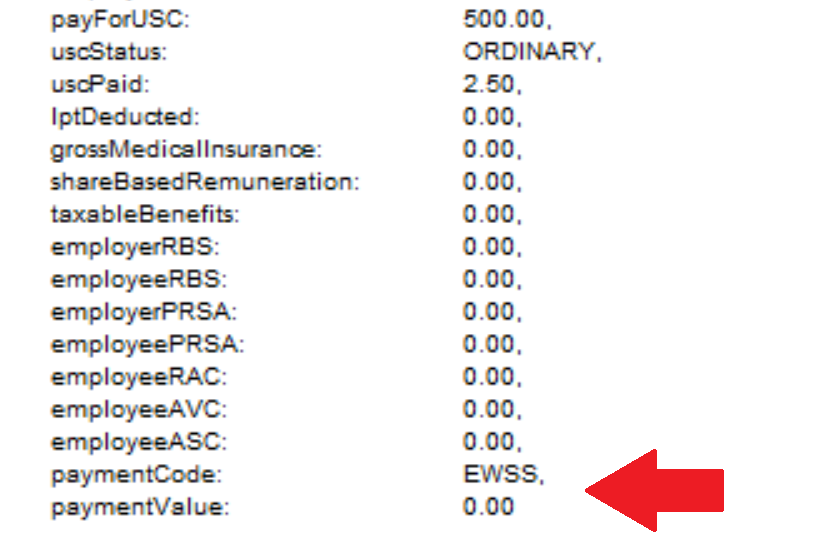

- should include ‘EWSS’ as the payment type in the ‘Other Payments’ section on the payroll submission

- input the digit zero or a value up to €1 (depending on the capability of the payroll package)

- should not include the EWSS ‘Other Payment’ details on the payslip they provide to the employee.

We can confirm that the above criteria are automatically taken care of in Thesaurus Payroll Manager, where you have instructed the software that an employee can be claimed for under EWSS.

Example extract from the payroll submission file:

Therefore there is no manual intervention required by the user.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.