Payment was different

Since the introduction of PAYE Modernisation, a dedicated facility is available within Thesaurus Payroll Manager in order to facilitate corrections that may be needed from time to time to your payroll.

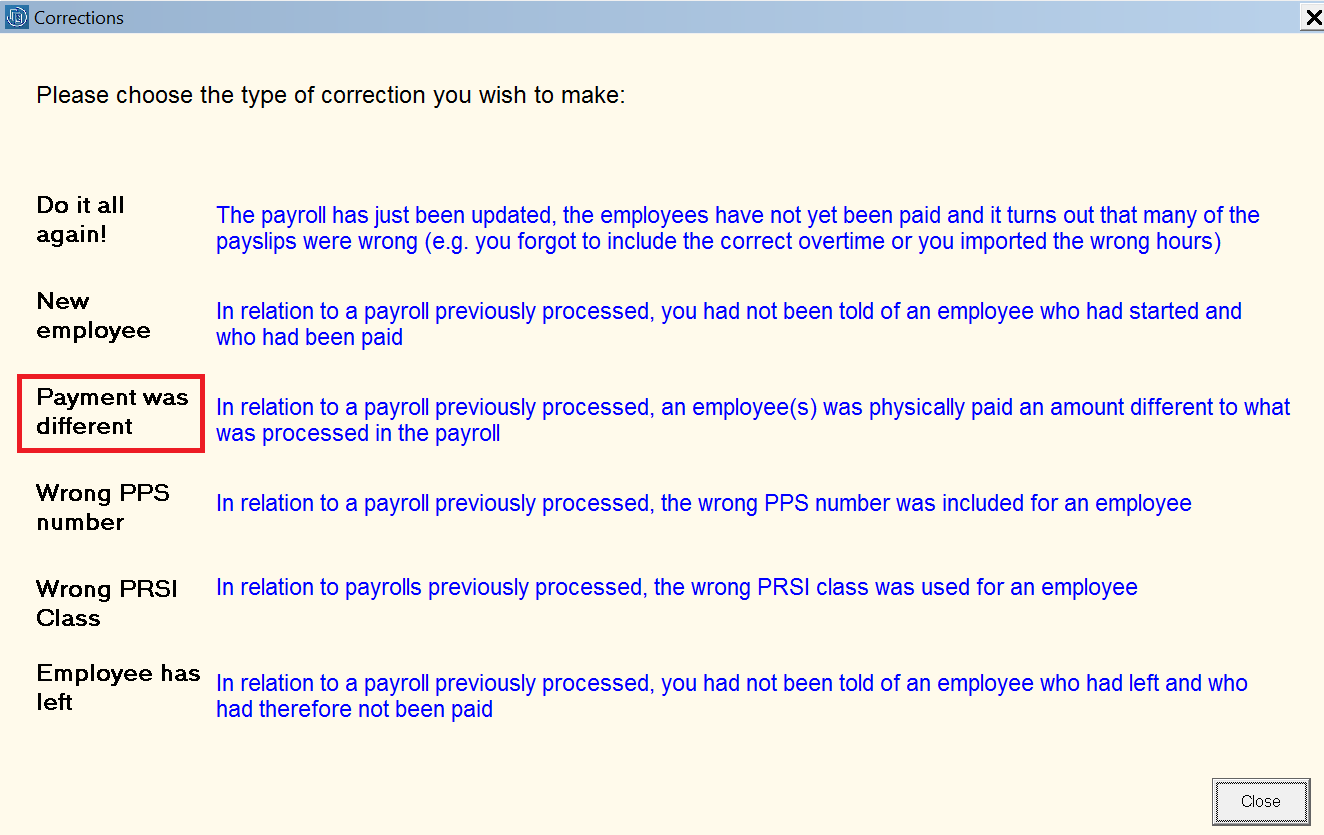

The Corrections utility can be accessed by clicking on 'Corrections' on the menu bar:

The correction type 'Payment was different' as highlighted above is to be used where, in relation to a pay run previously processed, it turns out an employee was physically paid an amount different to what was processed in the payroll.

To perform this type of correction:

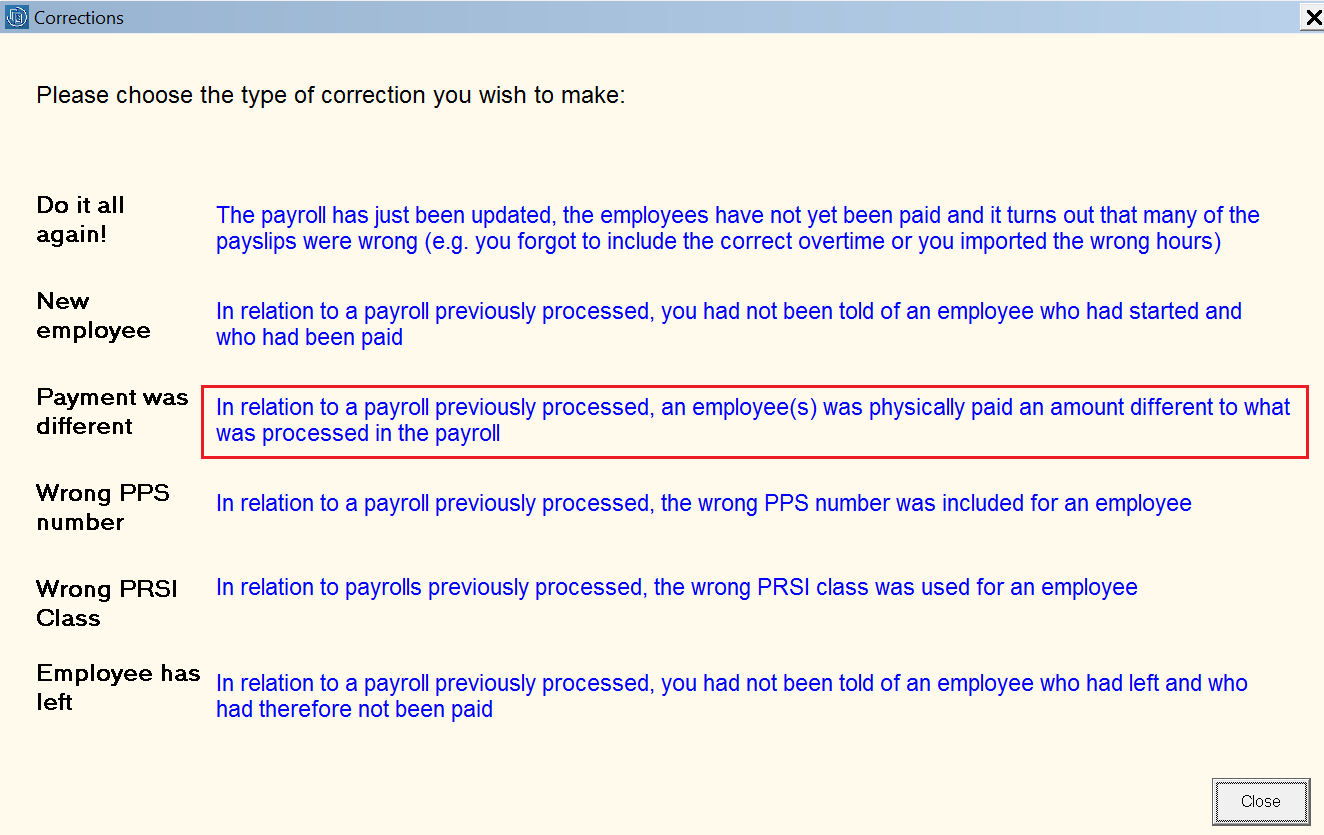

- Select 'Corrections' on the menu bar, then click on the statement for 'Payment was different':

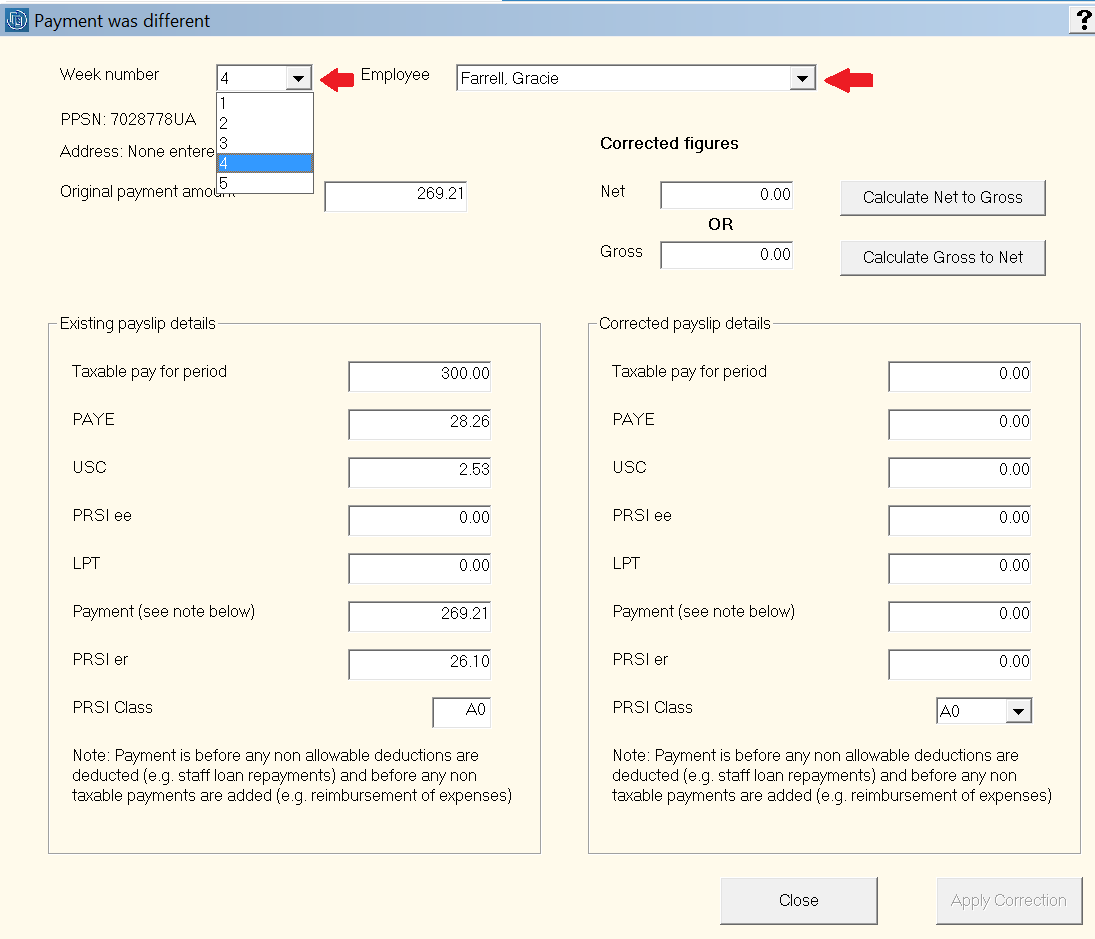

This will open the 'Payment was different' utility.

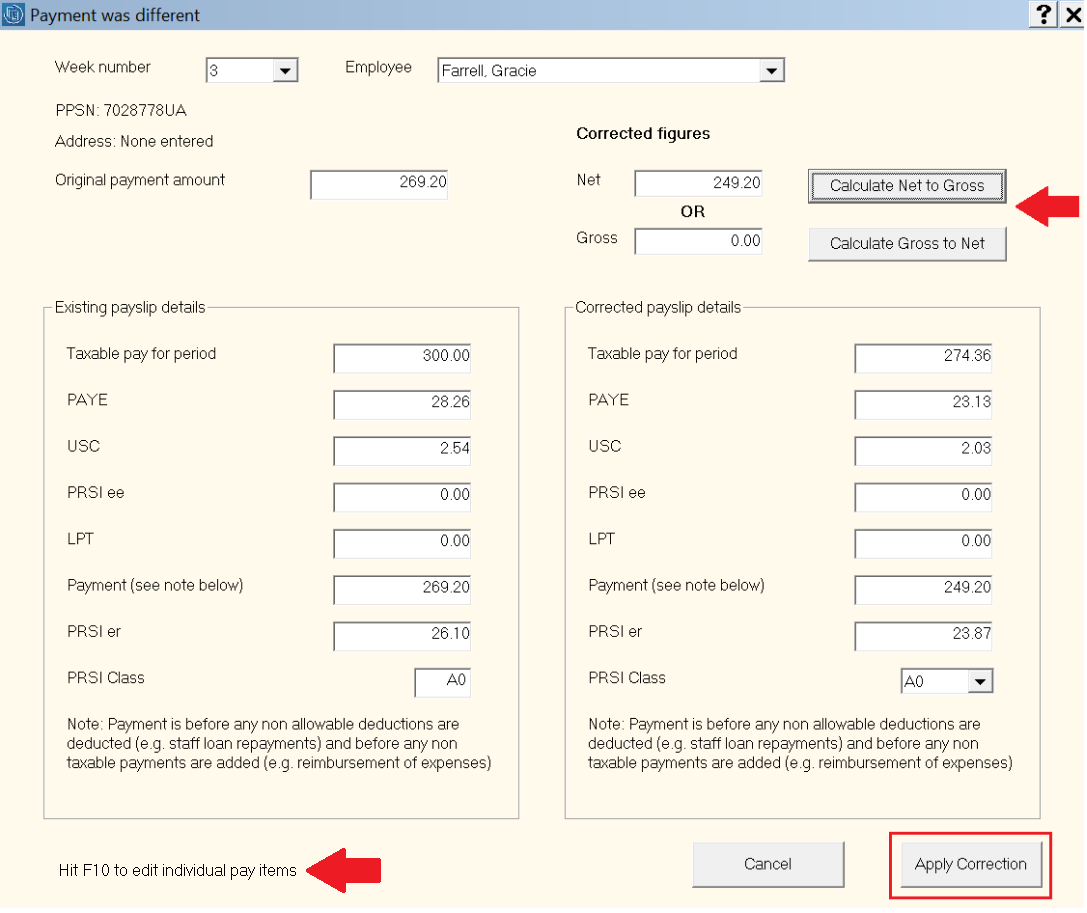

- Select the period number you wish to make the correction for

- Next, select the employee for whom you wish to make a correction for from the drop down menu

On the left hand side, the selected employee's original payment amount and the associated deductions will be displayed on screen.

- On the right hand side, enter the employee's correct gross pay or net pay accordingly.

a) If entering a net figure, click Calculate Net to Gross

b) If entering a gross figure, click Calculate Gross to Net

c) Alternatively, press function key F10 on your keyboard to edit individual pay items instead

The software will now determine the applicable deductions based on the corrected pay amount entered.

Please note: the payment amount displayed is before any allowable deductions are deducted (e.g. staff loan repayments) and before any non taxable payments are added (e.g. expense reimbursements).

- If happy to proceed, simply click 'Apply Correction'

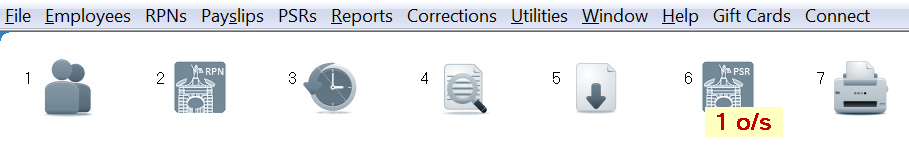

- A Correction PSR will now be prepared by the software. If you have no more corrections to make, simply close out of the Corrections utility and access Process Icon No. 6 to submit the correction PSR to Revenue.

- If, however, you have further corrections to make to payment amounts, either for the same employee or another employee, select the relevant period number and employee from the drop down menus and repeat the process above.

Please note: where further corrections are made for other employees in a pay period in which a correction PSR has been created but not yet submitted to Revenue, the pending correction PSR will be updated accordingly to include the additional employee corrections processed.

If, however, a previously created correction PSR has already been submitted to Revenue, a new correction PSR will be created accordingly.

Also, where a payment correction is needed for more than one pay period for an employee, individual correction PSRs will be created for each applicable pay period, which can subsequently be submitted one by one to revenue through 'PSRs > Control Panel'.

Following the correction

- as soon as this type of correction is applied, the employee's payslip(s) will be updated accordingly to reflect the corrected payslip amounts.

The Print/Email Payslip utility can be accessed by going to Process Icon No. 7 or Payslips > Print/Email Payslips - Likewise, all associated payroll reports e.g. the Payroll Summary report, will now reflect the employee's corrected pay position

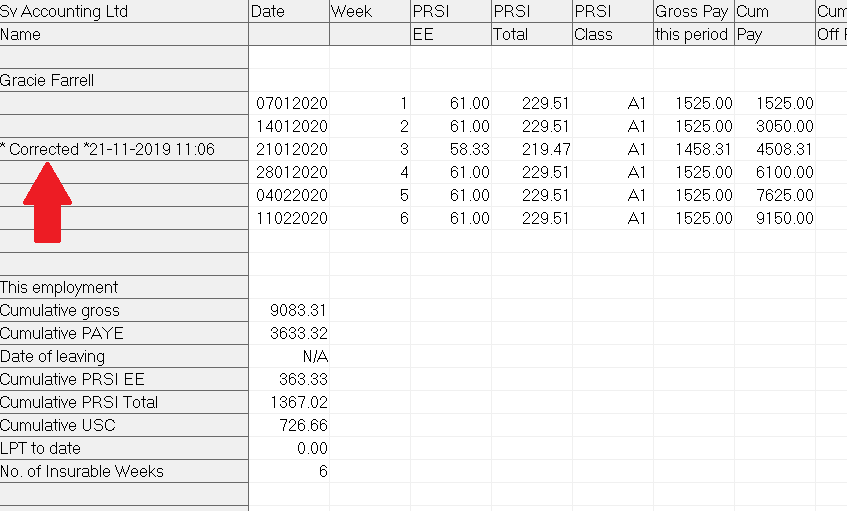

- The employee's Tax Deduction Card will also be updated to indicate which pay periods have been corrected by the user:

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.