Processing Starters

Since 1st January 2019, employers are no longer required to submit a P45 Part 3 or a P46 to Revenue to register a new employee.

Instead, to commence a new employment, an employer will now submit a Revenue Payroll Notification (RPN) request for the new employee.

This will create the employment on Revenue’s side and Revenue will send an RPN response back into the software advising of the tax credits and cut off points etc. to be applied to the employee's pay.

The employee’s start date will subsequently be reported to Revenue in the first Payroll Submission Request (PSR) you submit for that employee.

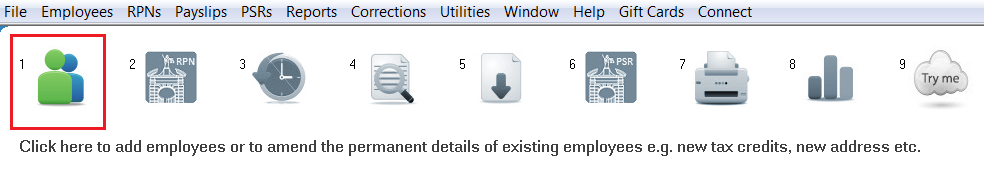

- In order to fulfil these new requirements, you will first need to set up an employee record for the employee – simply select Process Icon No. 1, followed by ‘New’ to do this:

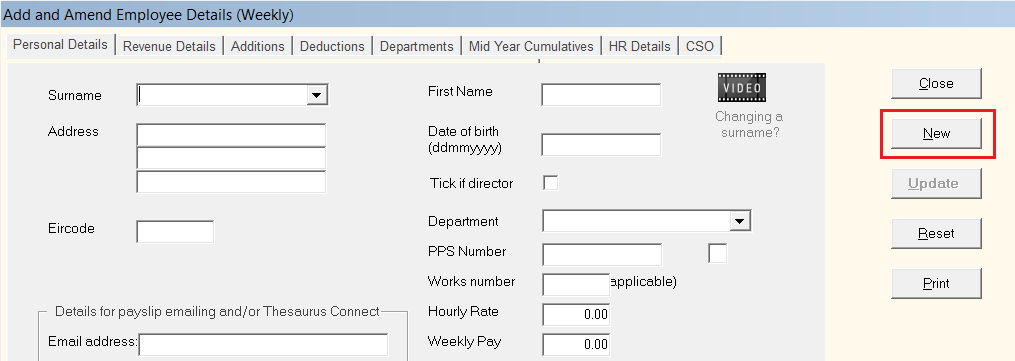

- Complete the Personal Details screen for your new employee accordingly

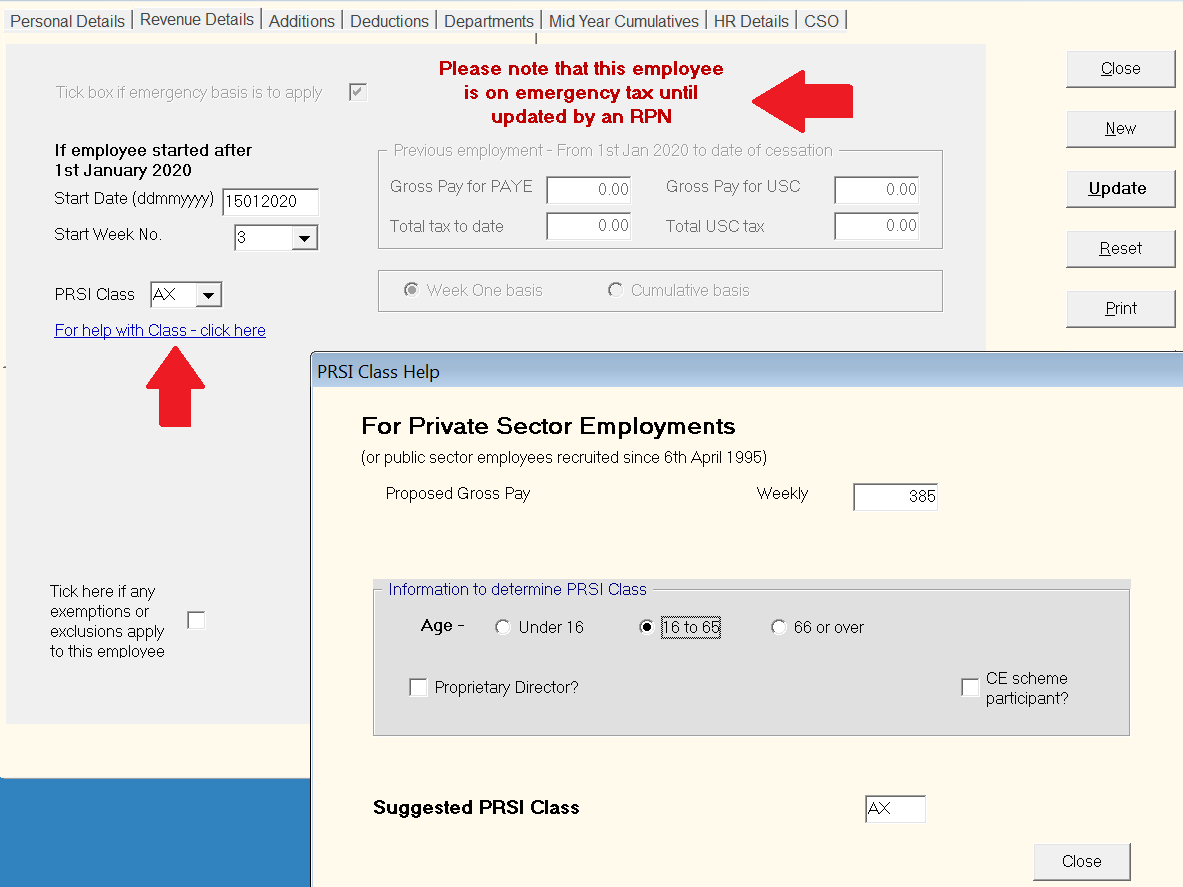

- Next, click into Revenue Details - the employee will automatically be placed on emergency tax until they are updated by an RPN.

- Enter the employee’s start date in the field provided, select their start week number and select their PRSI Class using the drop down menu. If unsure of the PRSI Class to apply, a help link is provided.

- Should the new employee have any additions or deductions to apply, complete these sections accordingly.

- HR Details and the CSO section should also be completed, as required.

- Press Update, when the employee record is complete.

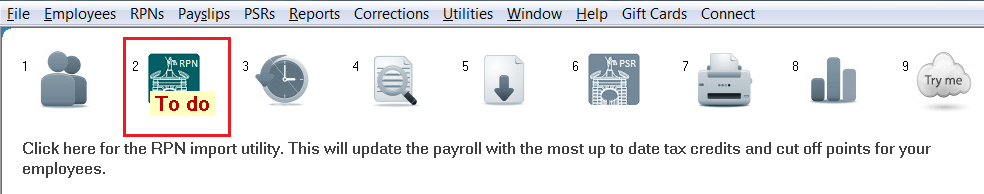

On closing out of the new employee record, you will now be prompted to send an RPN request to Revenue:

- Simply click Process Icon No. 2. to commence this task:

The software will automatically connect to Revenue’s systems and attempt to retrieve an RPN for the employee.

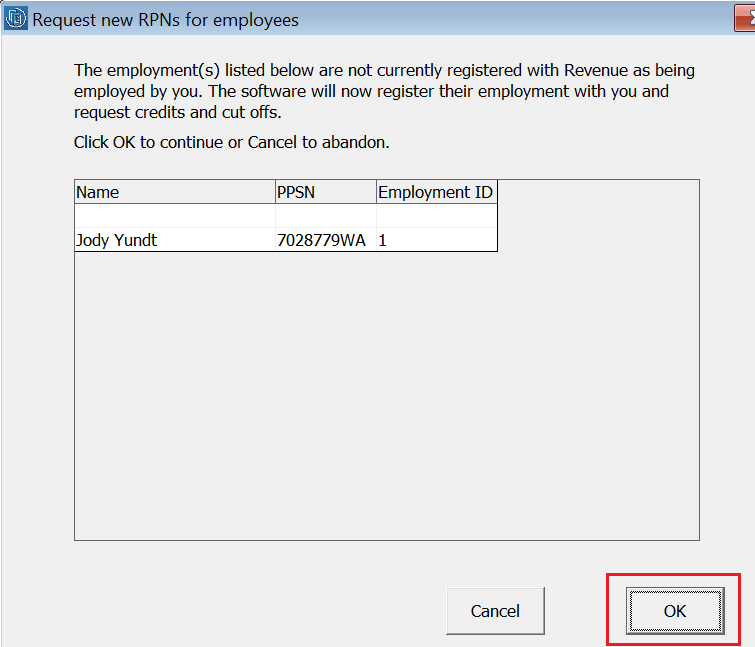

- If it is detected that the employee's new employment with you has not yet been registered with Revenue, this will be brought to your attention.

Clicking OK will thus register the new employment at Revenue's side and request tax credits and cut off points from Revenue:

Please note: an RPN response can only be received from Revenue for an employee where a PPS number has been provided and the PPS number has been entered in their employee record. If no PPS number is given to the employer, emergency tax will continue to apply until such time one is received.

In addition, if it is the employee’s first ever employment in Ireland, they must first register their new employment themselves using the Jobs and Pensions online service before an RPN can be received for them.

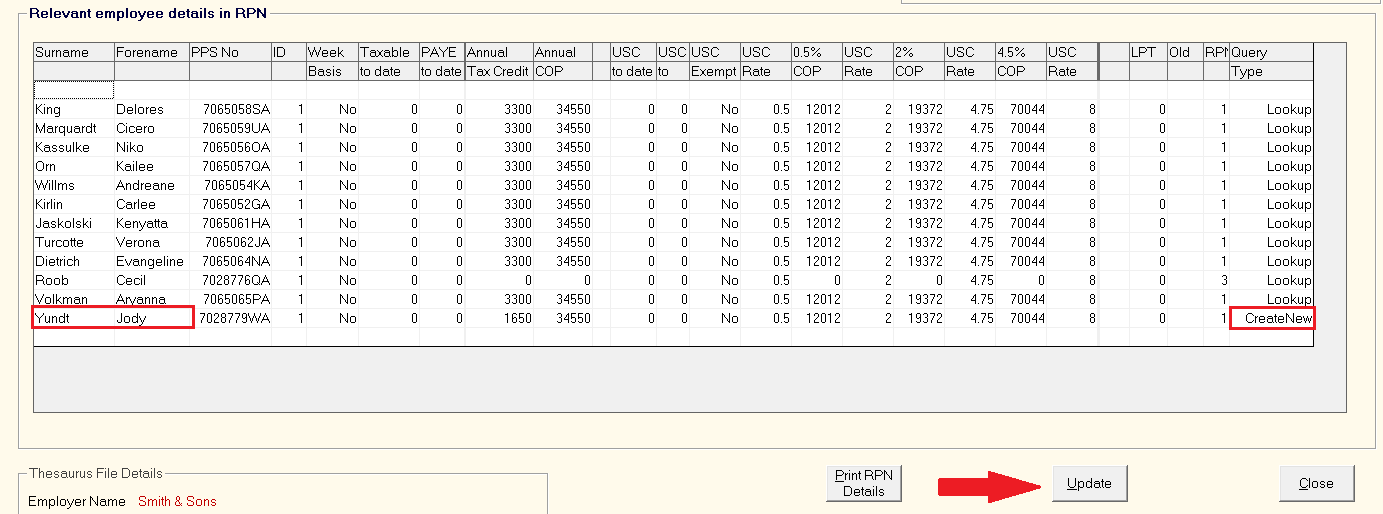

- Where an RPN response is received for an employee, details of this will be displayed on screen.

Click ‘Update’ to import the credits and cut off points shown into the new employee's record:

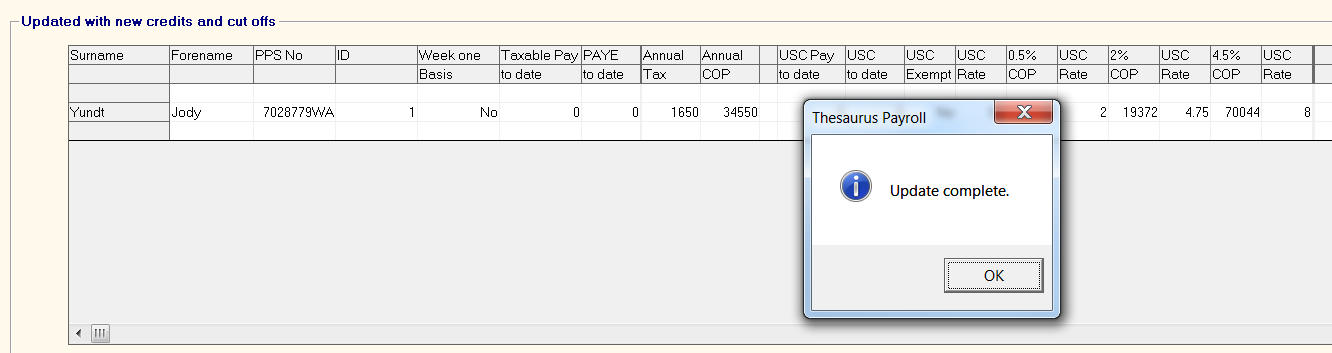

- The next screen will then confirm that the new employee has been updated with the revenue information retrieved from Revenue:

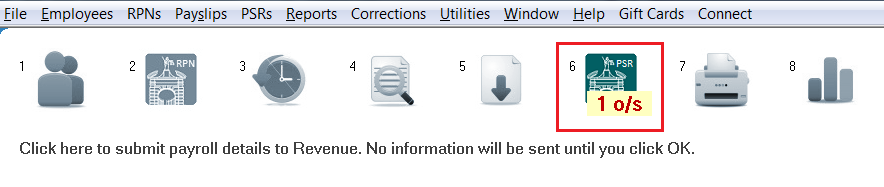

To subsequently report the employee’s start date to Revenue, the employee and their start date will be included in the next Payroll Submission you make to Revenue.

- Process your next pay run accordingly and you will be prompted to submit your payroll submission to Revenue using Process Icon No. 6:

- Prepare and submit your Payroll Submission (PSR) to Revenue in the normal manner.

On successful submission, Revenue will now be in receipt of the employee’s start date.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.