Do I have a Week 53?

When does a 'Week 53' occur?

This happens when a pay day falls on 31st December or, in a leap year, on 30th or 31st December.

Week 53 occurs when there are fifty-three weekly pay days in the year:

- In 2021, employers who pay wages on a Friday will have 53 pay days - thus a Week 53 payroll run

- In 2022, employers who pay wages on a Saturday will have 53 pay days - thus a Week 53 payroll run

Please note: Thesaurus Payroll Manager will always offer a Week 53 option subsequent to the completion of Week 52. However, it should only be used (i.e. payroll input and payslips finalised for week 53) if, on completion of week 52, there is a subsequent pay period within the same tax year.

What action should an employer take?

Thesaurus Payroll Manager automatically applies any USC cut off points, tax credits and cut off points on a Week 1 basis in the week 53 payroll, as per Revenue regulations. Therefore an employer can simply process their payroll in the normal manner as they would for previous pay periods.

Attention however must be drawn to the following:

Please note: if an employee's normal pay day has changed during this tax year or the preceding tax year, they are not entitled to the Week 53 concession for USC i.e. the additional USC cut off points do not apply.

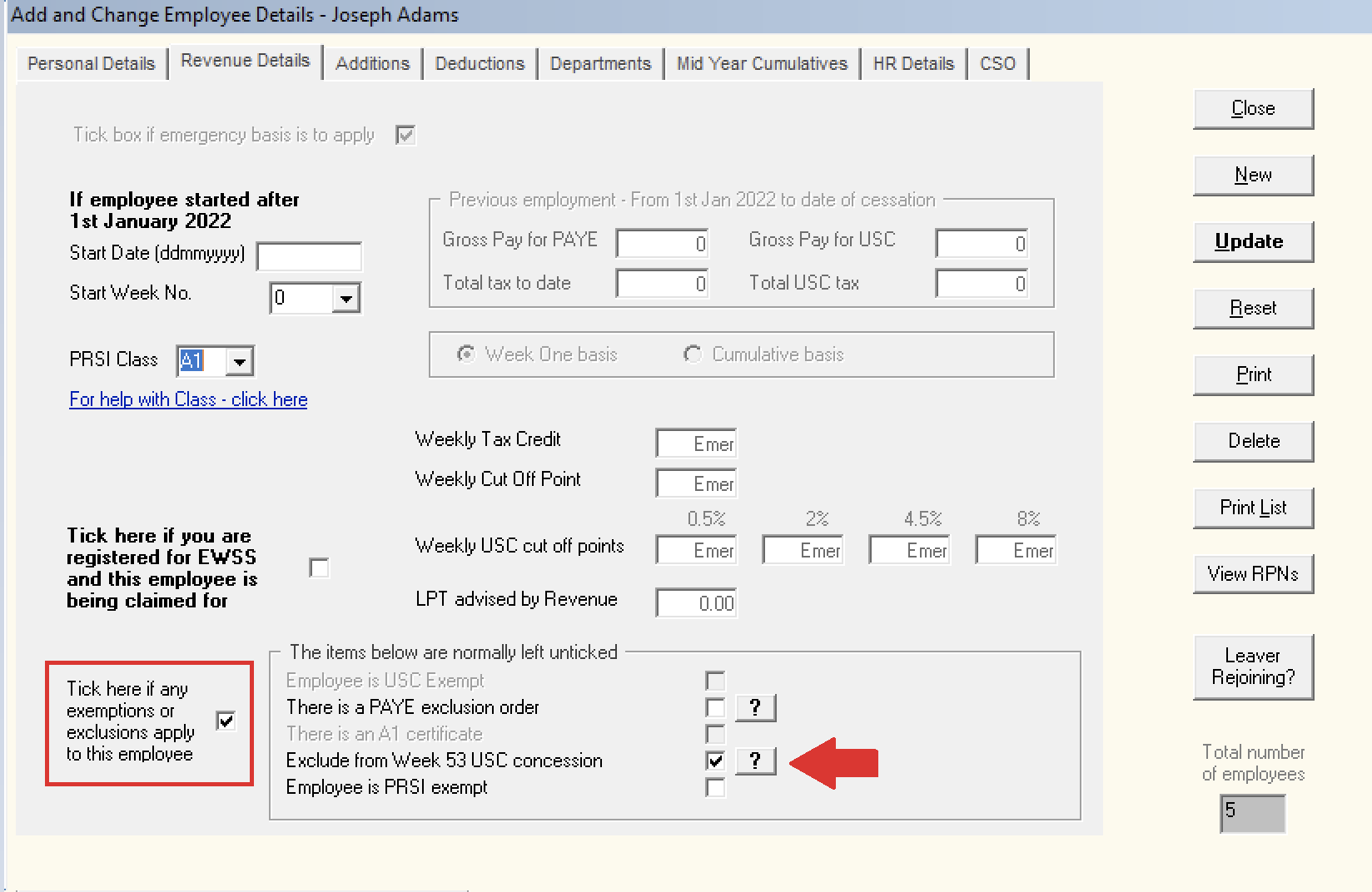

You will therefore need to instruct the software if the additional USC cut off points are not applicable to an employee. To do this, go to:

Employees > Add/Amend Employees > Select the employee > Click the Revenue Details tab > Tick to

indicate exemptions/exclusions apply > tick to exclude the employee from the week 53 USC concession >

update to save the change.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.