Additional Superannuation Contribution (ASC)

Additional Superannuation Contribution (ASC) was introduced on 1st January 2019, it replaced the Pension Related Deduction (PRD). Whereas PRD was a temporary emergency measure, ASC is a permanent contribution in respect of pensionable remuneration.

Application of ASC

Assessing ASC

Unlike PRD, ASC is only chargeable on pensionable remuneration. Pensionable remuneration includes:

- Basic Pay (excluding non-pensionable overtime) due to the public servant in respect of that period, and

- Allowances, emoluments and premium pay (or it's equivalent) which are treated as pensionable pay

ASC Treatment

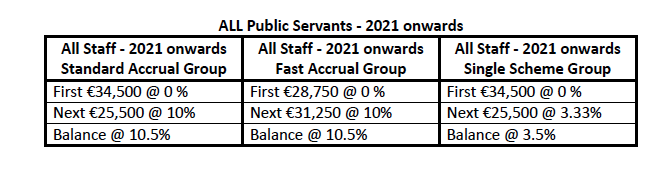

ASC Rates and Thresholds

Setting up the ASC Deduction in Thesaurus Payroll Manager

To access this utility go to Process ICON no. 1 OR Employees > Add/Amend employee details > Deductions Tab

- Select the employee to whom the deduction will apply.

- The ASC must be entered into the “Other Allowable Deduction” field as indicated.

- To enter the ASC simply type “ASC” into this dedicated narrative field, once you start to type the narrative the program will automatically complete the field for you.

Payslips > Weekly/Fortnightly/Monthly Input >

- Select the employee from the drop down list to whose earnings the ASC applies.

- Select “Deductions”. The ASC deduction will automatically calculate in line with the rates and bands and this automated deduction amount will be shown.

- To view the calculation of the ASC simply double click on the amount. A breakdown of earnings across each band and with the applicable rate will be shown.

Please note: the default ASC deduction is the Standard Accrual Group. To change to Singe Scheme Group, double click on the amount and select 'tick if member of the single scheme'.

Adjusting the ASC (override)

Should you disagree with the automated calculation of the ASC calculated by the program then simply type the desired deduction over the automated deduction amount. This manually entered amount will now be applied to the employee’s salary.

Alternatively, you can enter an overriding ASC percentage to apply on a week one/month one basis e.g. 10%.

Payslips

Additional Superannuation Contribution will display separately on the Employees Payslip as ASC under the deductions section.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.