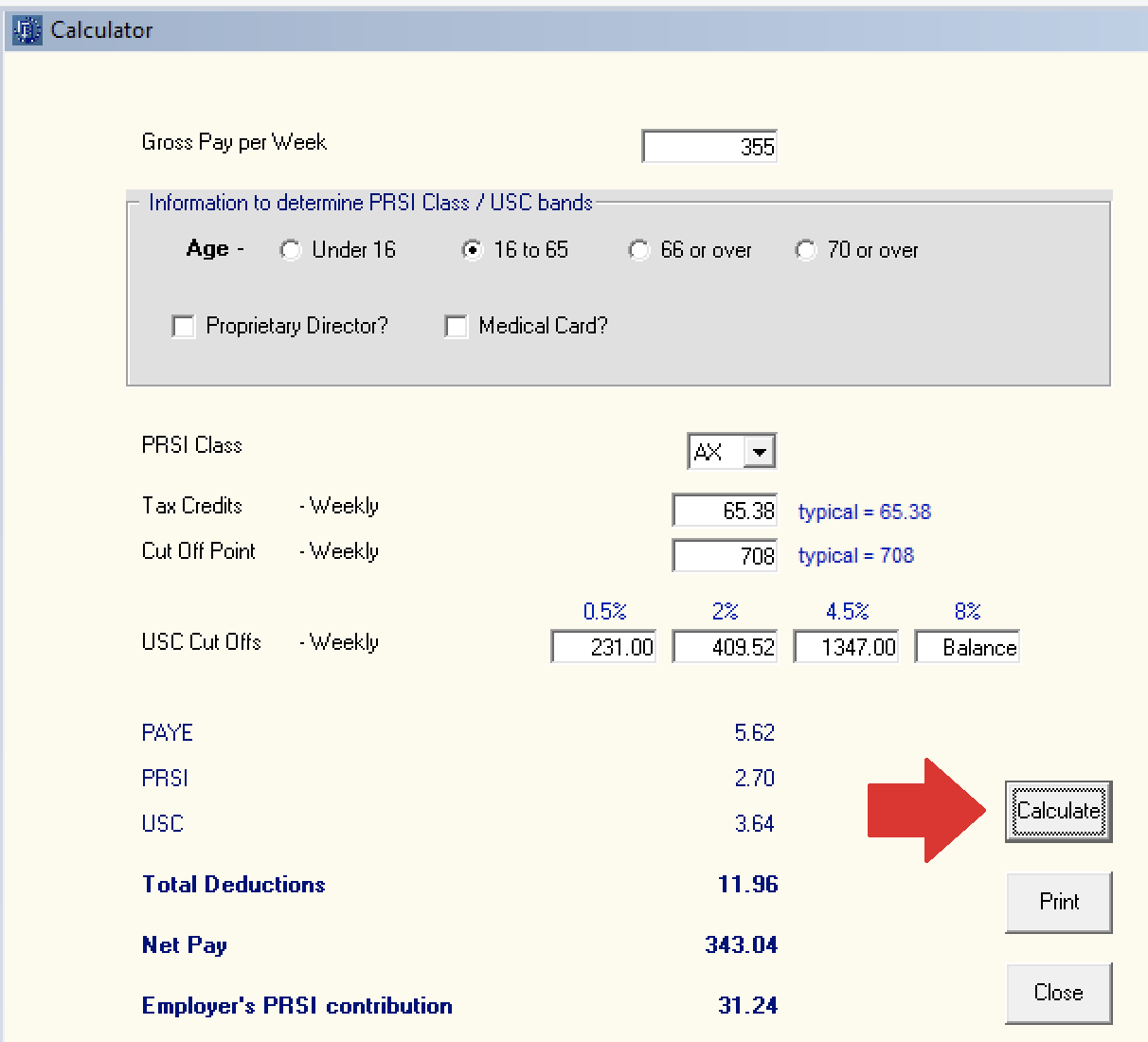

Calculator

2. Select the age range of the employee to ascertain an appropriate PRSI class and USC rates (providing Revenue are informed of the same criteria for USC purposes) to apply:

- Under 16

- 16 to 65

- 66 or over

- 70 or over

3. If applicable, simply select the category of employee:

- Proprietary Director

- Medical Card Holder

Based on this selection, a PRSI class will be assigned.

4. Enter the employee's applicable tax credit/cut-off point, as required. If unknown, the software will default to the standard tax credit and cut off point.

5. Click Calculate

Thereafter the PAYE, USC, PRSI deductions will be calculated giving a guide to the Net Pay payable to the employee.

Additionally, the Employer PRSI will be calculated to give the employer a guide to the additional employer payroll cost.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.