USC Exempt Status v USC Exempt Income

Employers should be aware of the difference between USC exempt status (as per RPN/Tax Credit Certificate) and employees in receipt of USC exempt income.

If an employee expects their income to be less than €13,000 in the tax year they can contact Revenue to make a declaration of same - it is only the employee themselves that can make this declaration. Revenue will update the employee's USC status to USC exempt and issue a new Revenue Payroll Notification (RPN) to the employer. The employer will follow this instruction and USC will not be deducted from the employee accordingly.

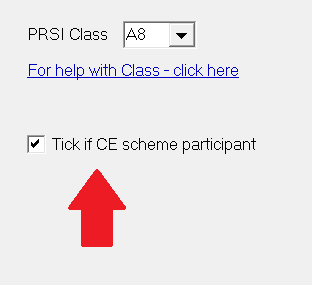

Simply tick the dedicated field 'Tick if CE scheme participant', as shown below.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.