Setting up a NECI Pension

NECI’s Electricians Pension Mortality & Sick Pay Scheme

- The NECI pension scheme has been approved by the Revenue Commissioners and is fully regulated by the Pensions Board.

- This scheme also allows employers to join.

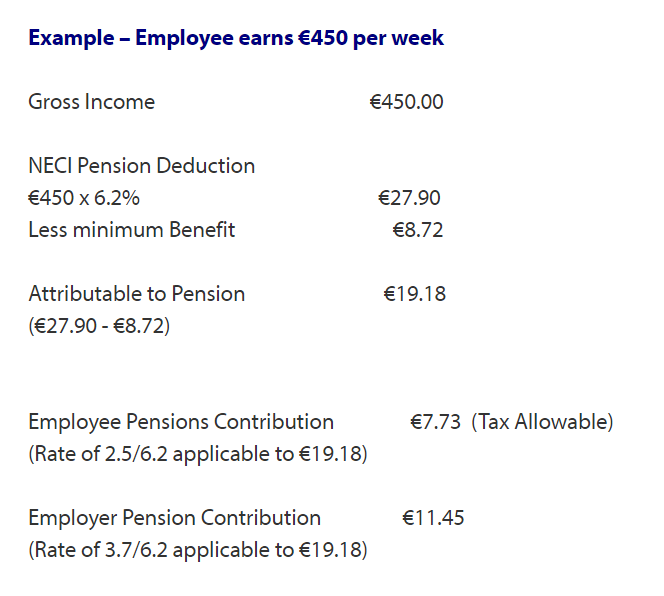

- The total contribution to the NECI pension scheme is at a rate of 6.2% of the employee's salary, subject to a minimum payment of €4.11 by the employee.

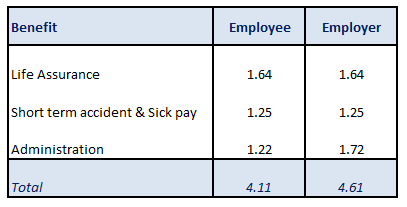

- A qualifying benefit week must meet the minimum benefit payment of €8.72 which is broken down as follows:

- The employee portion of the benefit of €4.11 is always the initial deduction from the employee's salary - this is not tax allowable.

- The balance of the deduction is a pension contribution which is tax allowable.

- Employers contribute 3.7% for every hour worked by each employee.

- Employees contribute 2.5% for every hour worked.

Setting up a NECI Deduction within Thesaurus Payroll Manager

- Select the employee to whom the NECI deduction applies

- Enter the employee's pay for the pay period

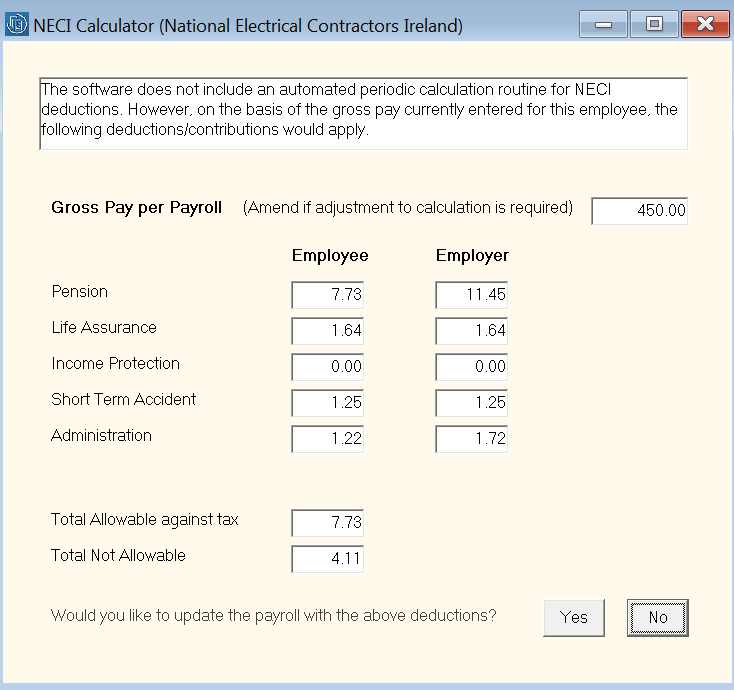

- Select Deductions

- Click NECI?

- You may choose to update the employee’s record with the figures shown. Simply click “Yes” to do this or “No” to change the employee pay on which the NECI contribution is to be made.

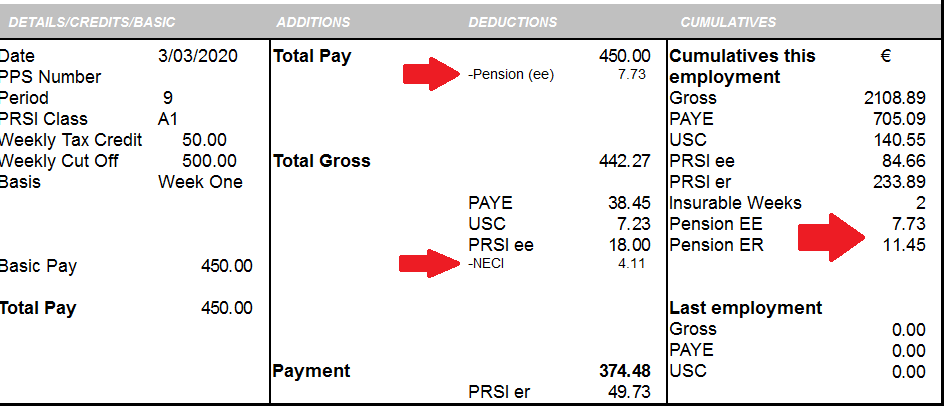

- Click 'Update' to save employee pay record and to preview the payslip.

- Once payslips have been updated and the pay period is rolled forward to the subsequent pay period, the NECI figure as calculated in the previous period will also be carried forward.

- Therefore, if the user amends the employee's gross income in the next pay period, the NECI deduction will not automatically recalculate based on the new gross income figure - the user must repeat the above process in order to recalculate the deduction and ensure accuracy.

The Employee's Payslip

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.