Cycle to Work Scheme

To set up 'Cycle to Work' in Thesaurus Payroll Manager, a tax allowable deduction can be created.

To do this:

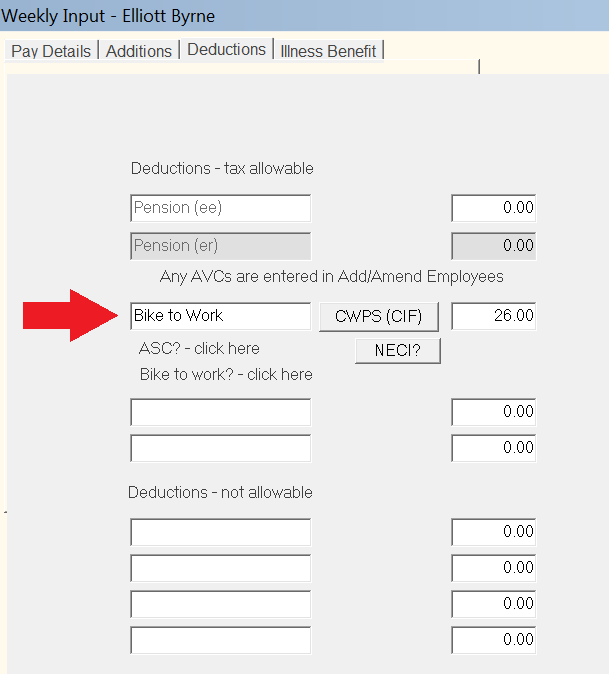

- go to Payslips > Weekly/Fortnightly/Monthly Input

- Choose the relevant employee and click into their Deductions section

- Enter a description (e.g. Bike to Work) in one of the fields provided for 'Deductions - tax allowable' and enter the periodic value of the deduction.

For example: if the total cost of the bicycle and equipment is €780 and the repayment period is 30 weeks, the weekly deduction amount will be €26.

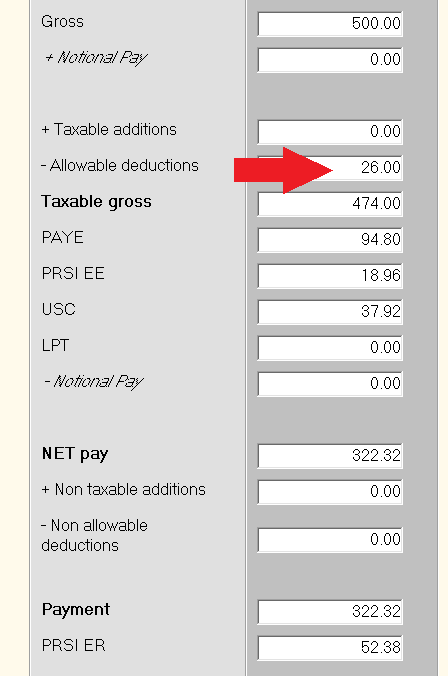

- Going forward, when the payroll is processed, the amount entered above will be deducted from the employee's wage before PAYE, PRSI and USC are calculated.

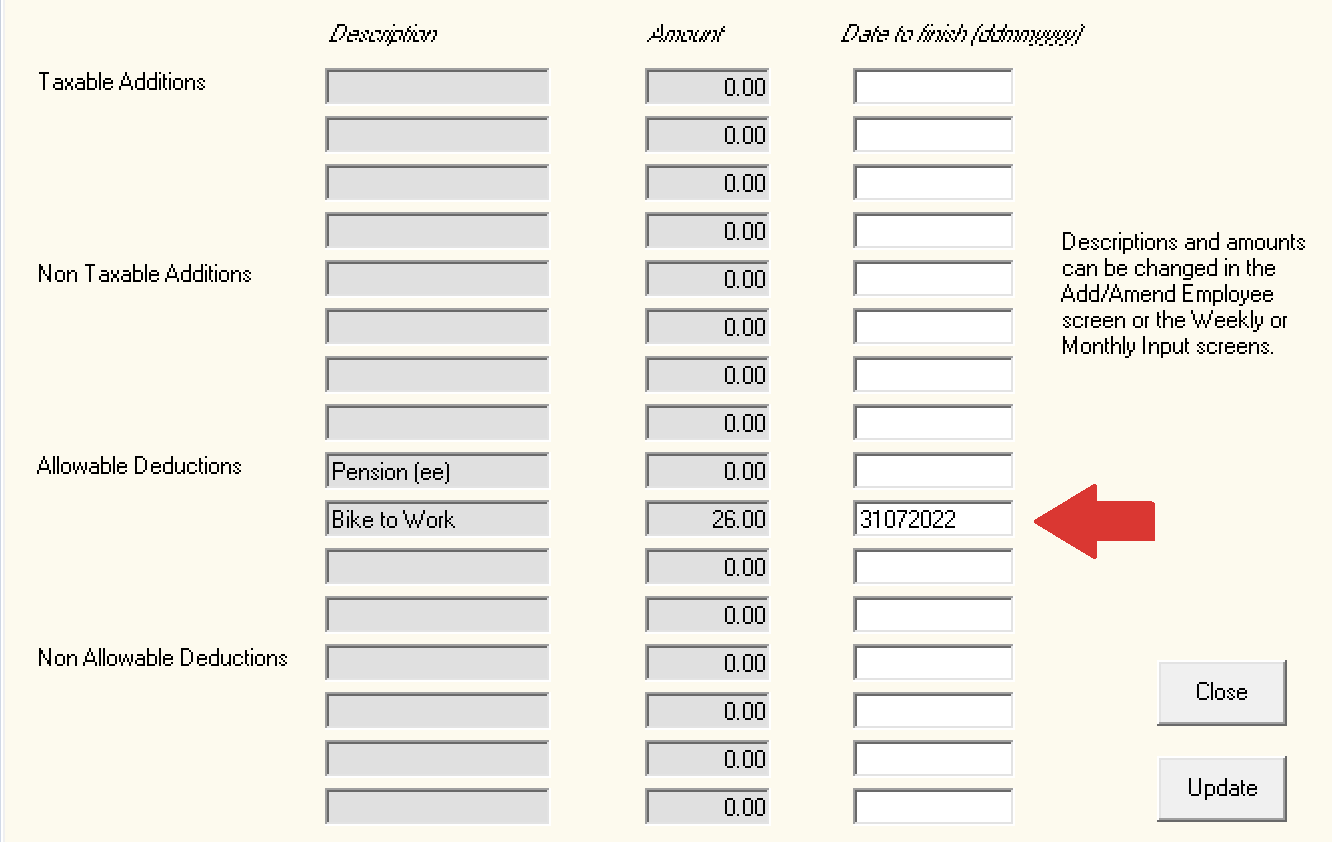

- An end date can be entered for the deduction by going to Utilities > 'Specify end dates for additions or deductions'.

- If an end date is not entered, it will be the user's responsibility to stop/remove the deduction from the employee's payslip once the total cost of the bicycle and equipment has been recouped.

Please note:

- There is no PAYE, USC or PRSI due on the cost of the bicycle and/or accessories up to the limit of €1,250 (and €1,500 for electric bikes).

- The period to avail of the cycle to work scheme is every four years.

- The maximum term for the repayment of the bicycle and equipment is 12 months.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.