BrightExpenses Integration

From 1st January 2024, employers are required to submit details of three categories of Non Taxable Expenses to Revenue every time payment is made to an employee for these expenses – most importantly, these details needs to be reported by the employer to Revenue ‘on or before’ payment is made to the employees.

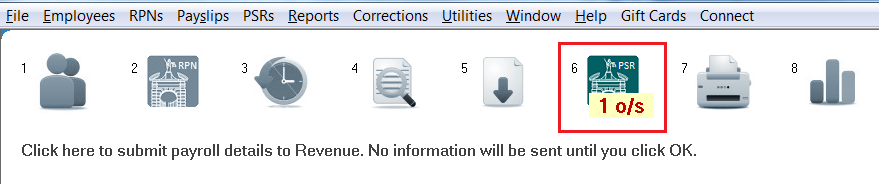

After updating a pay period, Thesaurus Payroll Manager will automatically create the Payroll Submission Request required by Revenue and you will see that process icon 6 will immediately prompt you that the submission is outstanding:

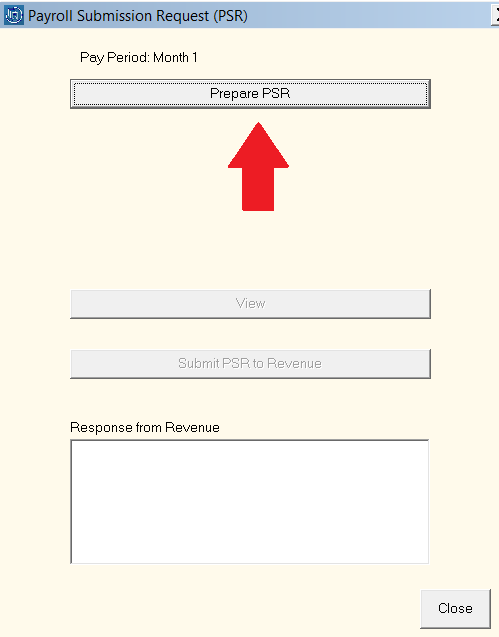

- To therefore submit your PSR to Revenue after you complete each pay run, click Process Icon No. 6, followed by ‘Prepare PSR’:

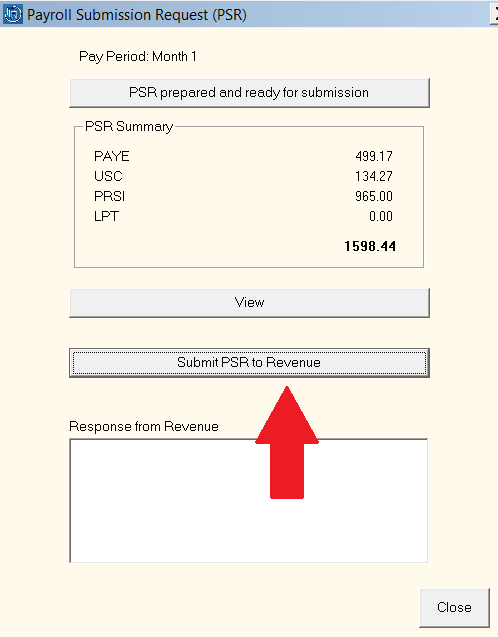

A summary of the PAYE, USC, PRSI & LPT totals included in the submission will be displayed on screen for you to view.

- Should you wish to view the detailed contents of the PSR before submission, click 'View'.

- When ready to do so, click ‘Submit PSR to Revenue’:

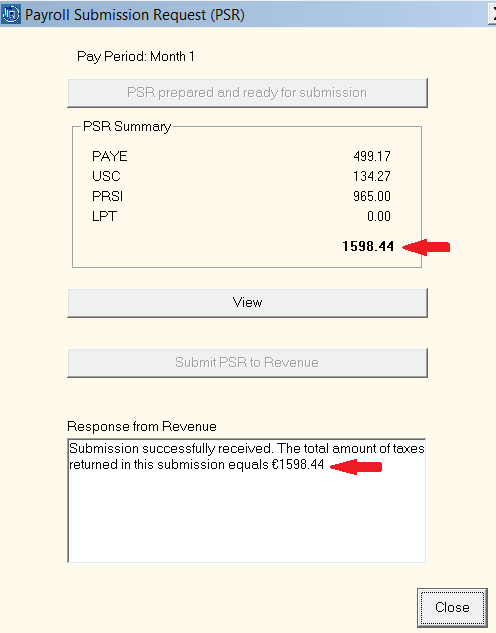

As soon as the submission is successfully received by Revenue, a confirmation response will be received back into the software confirming successful receipt, as well as the total amount of taxes that were included in the submission.

- Press 'Close' to exit the PSR utility.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.