Operating Statutory Sick Pay in Thesaurus Payroll Manager

Overview

- The Sick Leave Act came into effect on the 1st January 2023.

- It has been introduced to all workplaces across Ireland and is being phased in over four stages, from 2023 to 2026

- The SSP scheme started with three days' entitlement in 2023, rising to five days this year 2024, seven days in 2025, and ten days in 2026.

- Statutory sick pay (SSP) will be paid by employers at a rate of 70% of an employee’s wage, subject to a daily maximum threshold of €110. This may be revised by ministerial order at any time in line with inflation and changing incomes.

- An employee must obtain a medical certificate to avail of statutory sick pay, and the entitlement is subject to the employee having worked for their employer for a minimum of 13 weeks. Once entitlement to sick pay from their employer ends, employees who need to take more time off may qualify for illness benefit from the Department of Social Protection subject to PRSI contributions.

SSP & Thesaurus Payroll Manager

- SSP functionality is now included in Thesaurus Payroll Manager.

- Guidance on how to use the SSP feature within Thesaurus Payroll Manager is provided below.

Calculating & Applying SSP to an Employee's Payslip

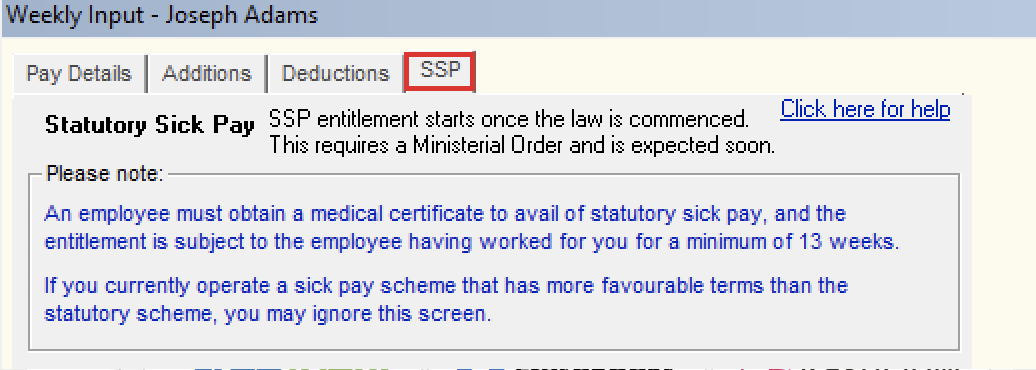

1) Go to Payroll > Weekly/Fortnightly/Monthly Payroll

2) Select the employee and access their SSP feature

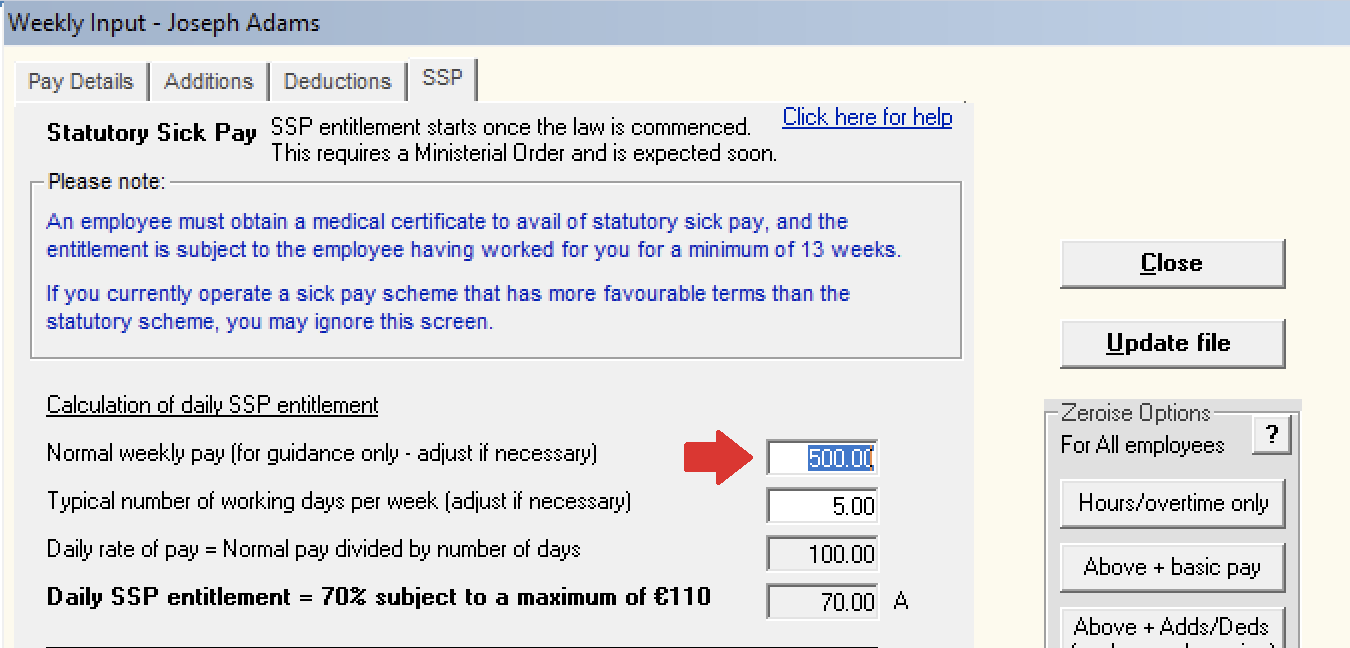

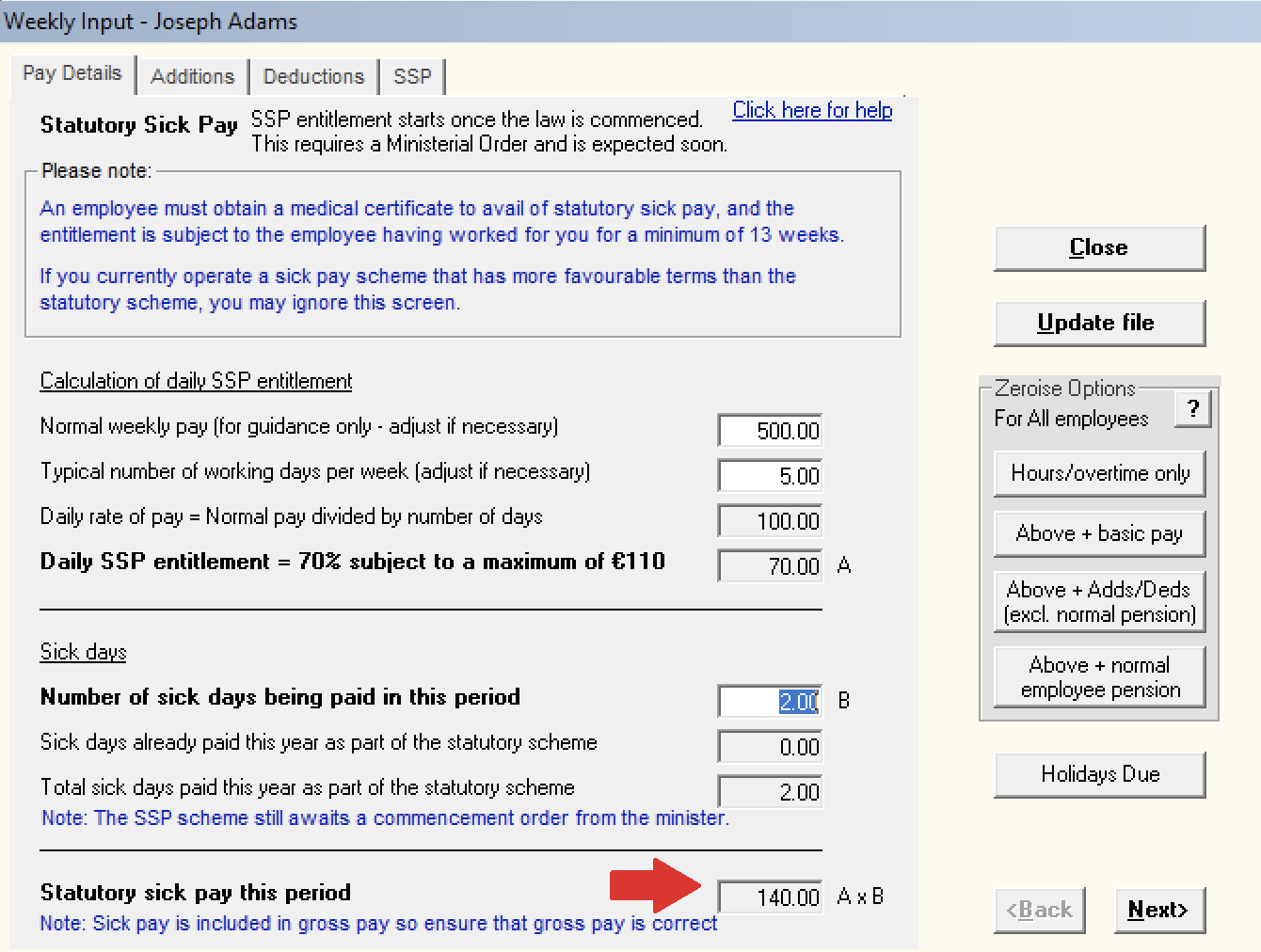

3a) Enter the employee's 'normal periodic pay' - see notes below for guidance:

- The normal periodic pay displayed by default is for guidance only.

- The first time you access an employee’s SSP screen, it will be assumed that the current gross pay entered for the employee is their ‘normal periodic pay’ for SSP purposes and this will be remembered by the software going forward.

- Should the employee’s gross pay change in subsequent pay periods and SSP applied, then a warning message will appear to flag that there has been a change to the employee’s gross pay and for the user to double check what the normal gross pay for SSP purposes should be.

- It is user responsibility to ascertain the correct normal periodic pay to use.

- Should you wish to adjust the normal periodic pay displayed, simply type in the new normal periodic pay amount required. Where a new amount is manually entered by the user, this will be remembered and used going forward, until a further manual change is made.

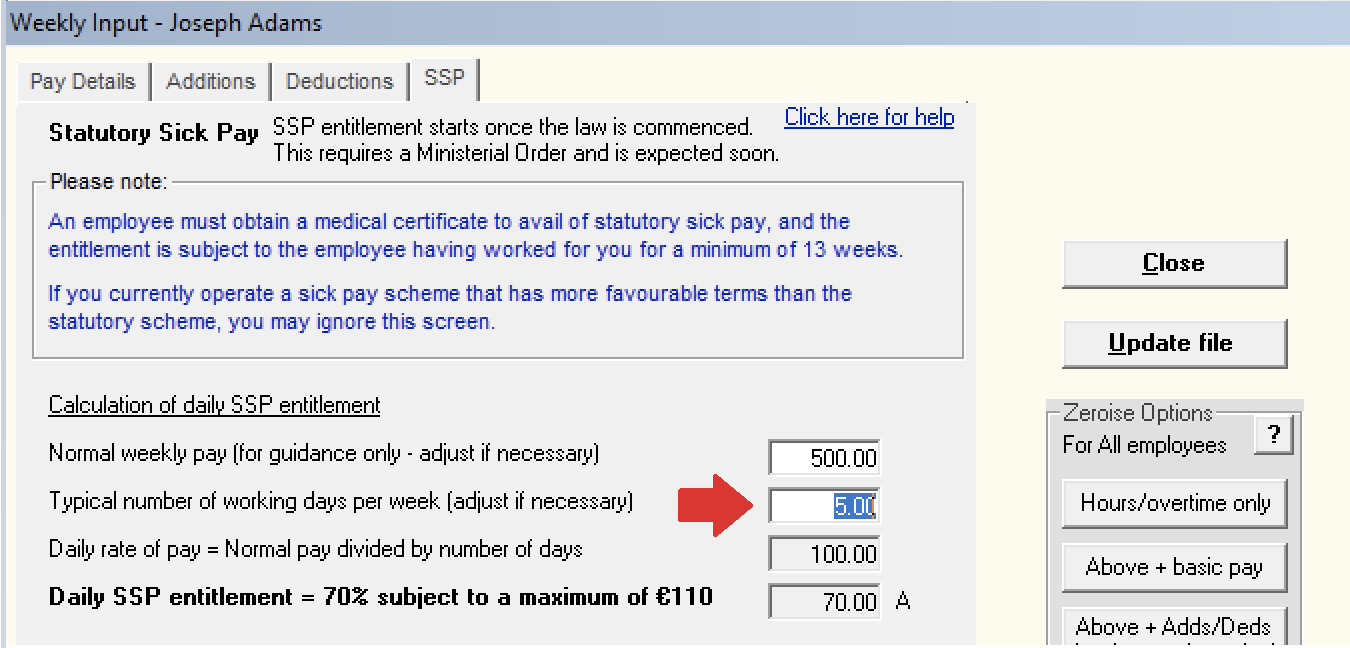

b) Enter the employee's typical number of working days in the period:

- By default, this will be 5 if weekly, 10 if fortnightly, or 21.66 if monthly.

- Should you wish to change the typical number of working days displayed, manually adjust as required. Where a manual change is made to the number of days, this will be remembered and used going forward, until such time that a further manual change is made.

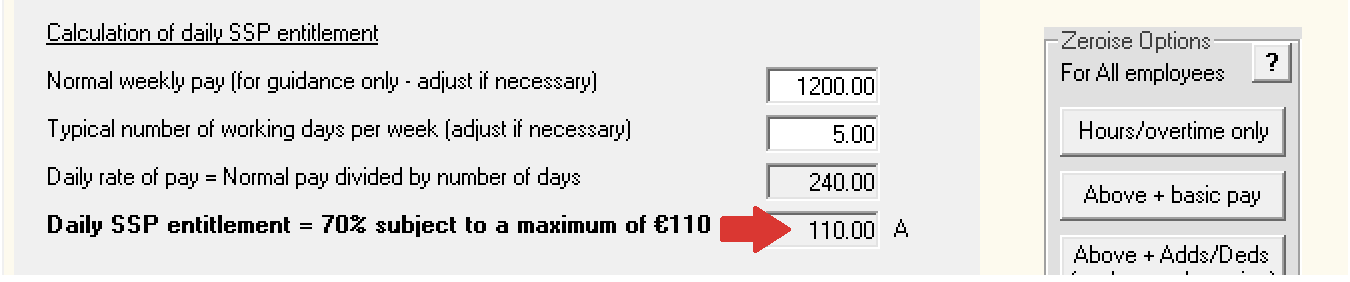

c) Using the normal periodic pay and the typical number of working days entered, the software will now automatically ascertain the employee's daily rate of pay and their daily SSP entitlement.

Points to note:

- Daily SSP entitlement is currently set at 70% of an employee's daily rate of pay subject to a maximum of €110.

- Where an employee's daily SSP entitlement calculation exceeds the maximum, it will be capped at €110 per day.

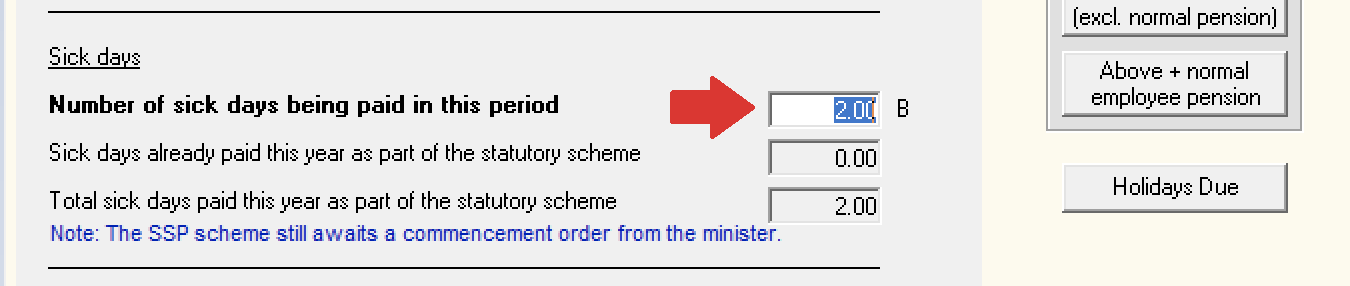

4) Next, enter the number of sick days being paid to the employee in the current period

- Once the pay period has been updated, this field will then zero-ise.

The software however will keep a record of statutory sick days already paid in the year and display this information on screen when you next access the employee's SSP feature - This screen will also highlight the maximum number of SSP days that the employer is obliged to pay under the scheme. It is important to note however that the software will not prevent the user from paying for more days than they are obliged to, as some employers may decide to do this at their own discretion.

5) Using the daily SSP entitlement ascertained (A) for the employee and the number of sick days entered (B), the software will now automatically calculate the statutory sick pay amount payable to the employee in the current pay period.

Important notes to the above:

- Once the SSP screen has been completed, review the employee's overall gross pay amount for the pay period to ensure it is correct.

Please note: any SSP calculated using the SSP feature will automatically be included in the employee's gross pay figure and will not be itemised out separately on the employee's payslip. Therefore users must take care to ensure the correct overall gross pay is entered for an employee, reducing down or zero-ising the employee's normal basic pay where this is required.

- SSP is treated like gross pay for the purpose of tax, USC, and PRSI.

- Where SSP is included in a particular pay period, a note will appear on the employee’s payslip highlighting this.

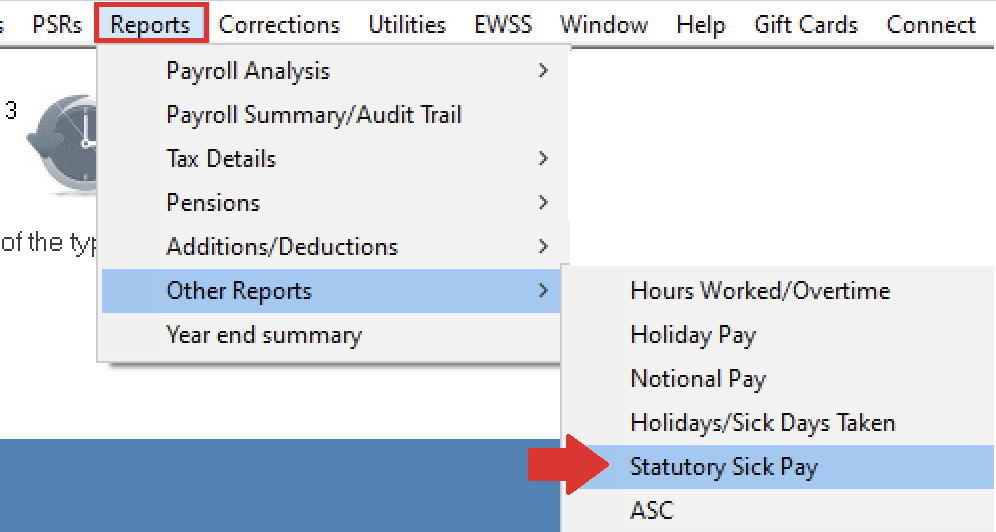

SSP Reporting

To facilitate SSP reporting, the number of SSP days entered for an employee and the associated statutory sick pay for each period are recorded by the software.

- An SSP Report can be accessed at any time under ‘Reports > Other Reports > Statutory Sick Pay’:

SSP Corrections

Should you need to make a correction to SSP that has been processed in a prior pay period, this can be facilitated within the Corrections utility.

- Go to Corrections > Payment was different

- Select the period number and the employee you wish to correct

- Press function key F10 to bring up an additional screen to allow you to edit individual pay items

- Make the necessary SSP correction as required - a correction to both SSP days and pay is facilitated

- Click Apply Correction when ready to do so

- A Correction PSR will now be prepared by the software. If you have no more corrections to make, simply close out of the Corrections utility and access Process Icon No. 6 to submit the correction PSR to Revenue.

Please note: where an amendment to the number of SSP days is the only correction being made, then a Correction PSR will still be created. As there are no changes to the employee's pay, there is no requirement to submit this correction PSR. Instead, users can simply mark this correction PSR as already sent by going to 'PSRs > Control Panel > right click on the relevant submission and select ‘Mark all payslips as sent’.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.