Accruals

AN ACCRUAL IS TAKING INTO ACCOUNT AN EXPENSE, WHICH HAS ACTUALLY BEEN INCURRED WITHIN THE RELEVANT ACCOUNTING PERIOD, BUT NOT INVOICED UNTIL THE SUBSEQUENT ACCOUNTING PERIOD.

ACCOUNTS PRODUCTION > ACCRUALS

An accrual is taking account of an expense incurred therefore only the expense accounts are listed on this screen.

Date

Enter date the accrual is effective, normally end of the accounting period.

Account Name

Select the appropriate expense account. Enter the amount you are accruing opposite the account name.

Post Entries

Click on Post Entries to process and save the entry.

Complete Accrual Entry:

Debit Expense Account Profit and Loss Account

Credit Accrual Account Balance Sheet Account

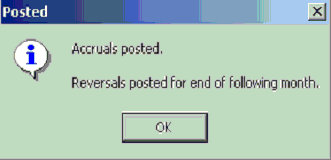

Upon selecting “Post Entry” the following message appears to confirm the journal has been posted.

Please Note: the message indicates that the REVERSAL of the accrual has automatically been posted on the last day of the following month.

To view the completed accrual journal entry go to the daybook.

FILE > DAY BOOK AND CORRECTIONS

Date Range

Enter the relevant date range (remember to include the reversal date which is at the end of the following month)

The automatic reversal journal can be viewed here also.

PLEASE NOTE: THE DELETION OF THE ACCRUAL THROUGH THE DAY BOOK WILL NOT AUTOMATICALLY DELETE THE REVERSAL ENTRY - THIS AUTOMATICALLY GENERATED REVERSAL ENTRY WILL NEED TO BE MANUALLY DELETED ALSO.

IN ADDITION, THE AMENDMENT OF THE ORIGINAL ACCRUAL AMOUNT THROUGH THE DAYBOOK (USING THE F4 FUNCTION) WILL NOT AUTOMATICALLY AMEND THE REVERSAL AMOUNT - THIS WILL NEED TO BE MANUALLY AMENDED ALSO IF REQUIRED.