Bad Debts

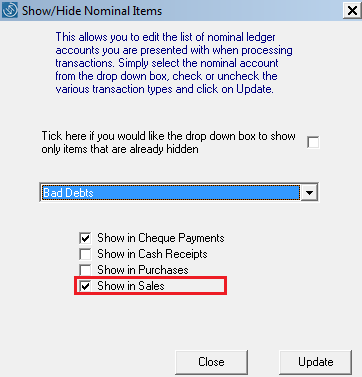

To write off a customer invoice as a bad debt, first ensure that the 'Bad Debts' nominal account is flagged for viewing within your Sales transactions screens:

Go to Setup > Show/ Hide Nominal Accounts:

- Select 'Bad Debts' from the drop down list

- Tick to flag the account for viewing in 'Sales' (if not already done so)

- Click 'Update'

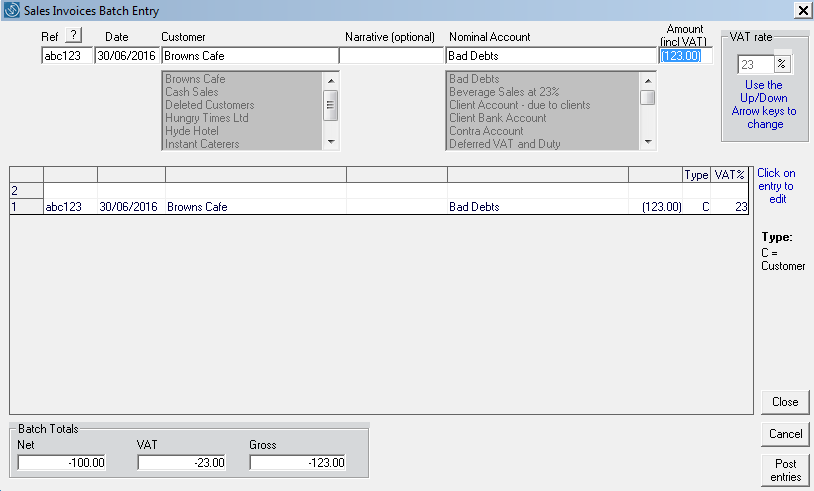

Go to Sales > Batch Entry:

- Enter relevant reference, date and choose the customer (also enter a narrative if required)

- Choose “Bad Debts” as the Nominal Account

- Enter the VAT inclusive amount of the invoice as a MINUS and choose the VAT rate that was applied to the original invoice.

- Post entry

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.