Principal Contractors & RCT

Principal Contractors are now obliged to notify the Revenue through ROS of all relevant contracts entered into and all relevant payments before they are made. Revenue then respond to the Principal Contractor, setting out how much tax, if any, they must withhold from the Subcontractor’s payment. The rates of tax are currently set at 0%, 20% or 35%.

Contract Notification

The principal contractor must notify Revenue through ROS of all relevant contracts entered into. Before notifying the contract, the principal contractor must satisfy themselves as to the identity of the subcontractor.

Payment Notification

The principal contractor must notify Revenue through ROS of all relevant payments before they are made. The gross payment (VAT exclusive amount if the VAT reverse charge applies) must be advised to Revenue.

Deduction Authorisation

Revenue will respond to the Payment Notification with a Deduction Authorisation setting out how much tax, if any, must be withheld from the payment. The rates of tax are currently set at 0%, 20% or 35%. The Deduction Authorisation is sent electronically to the principal contractor. The principal contractor must provide a copy, or details, of the Deduction Authorisation to the subcontractor if tax has been deducted. If payments are made to subcontractors without Deduction Authorisation penalties may apply.

Deduction Summary/ Return

At the end of the filing period, a Deduction Summary is made available electronically to the principal contractor detailing all the payments notified to Revenue during the filing period. The principal contractor should check the Deduction Summary for accuracy and amend or add to, if necessary. Otherwise the Deduction Summary is deemed to be the return on the return filing date.

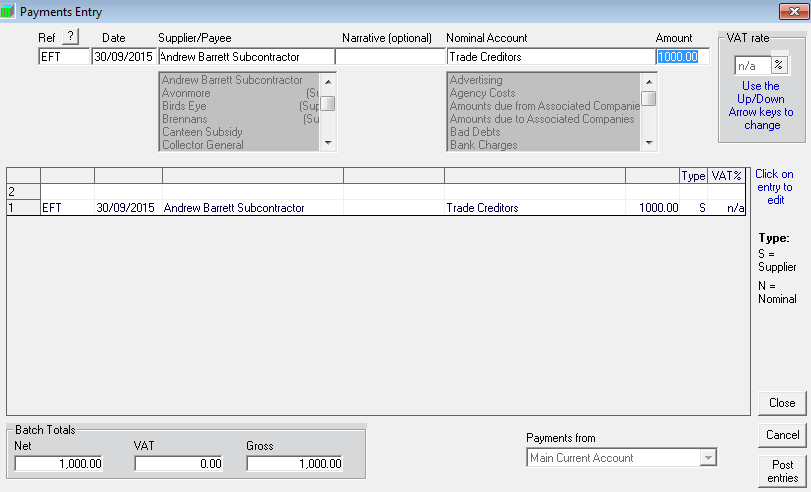

If the 0% tax rate applies to a Subcontractor

If the 0% tax rate applies to a Subcontractor, then payment can be made in full and recorded as normal. This payment should not include any VAT.

Bank > Payments

- Bank Account - Choose the Bank Account you wish to make payment from

- Reference - Enter your payment reference e.g. cheque number

- Date - Enter the date of payment

- Supplier Name - Select the Subcontractor you are making payment to

- Nominal Account - This should automatically default to Trade Creditors and cannot be changed

- Amount - Enter amount of the payment and then post the entry

If the 20% or 35% tax rate applies to a Subcontractor

If the 20% or 35% tax rate applies to a Subcontractor, the Principal Contractor is responsible for withholding the relevant contract tax from the payment made to the Subcontractor.

Therefore the Principal Contractor needs to:

a) Reduce the amount paid to the Subcontractor by the relevant contract tax element

b) Pay the relevant contract tax element into the “Relevant Contracts Tax” account so that it is recorded as payable to Revenue. (The “Relevant Contracts Tax” account records the amount of relevant contract tax payable or reclaimable to Revenue at any time).

Example: A Principal Contractor has received an invoice from a Subcontractor for €1,000 and Revenue have instructed that 35% tax must be withheld from the payment they make to the Subcontractor:

Therefore:

- 65% is the portion actually paid to the Subcontractor, i.e. €650

- 35% is withheld from the payment for transfer to Revenue, i.e. €350

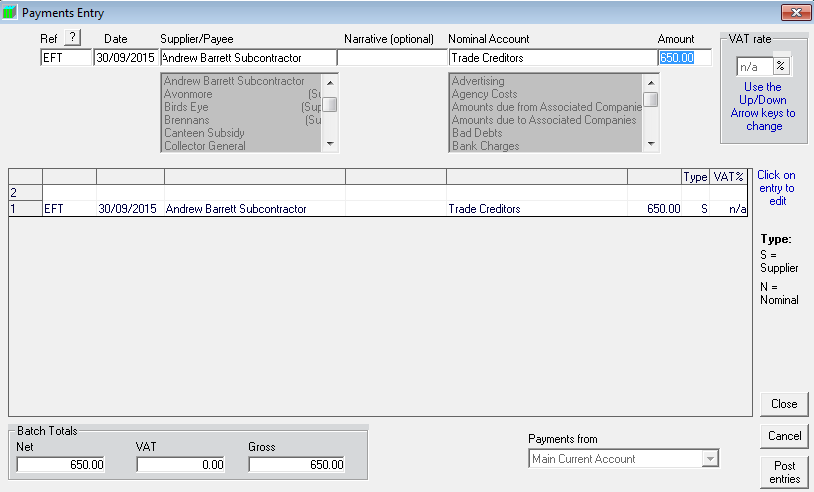

To record the 65% payment to the Subcontractor:

Bank > Payments

- Bank Account - Choose the bank account you wish to make payment from

- Reference - Enter your payment reference, e.g. cheque number

- Date - Enter the date of payment

- Supplier Name - Select the Subcontractor name

- Nominal Account - This will default to “Trade Creditors” as the invoice has already been recorded as payable and is in Trade Creditors to be paid off

- Amount - Enter the 65% payment figure

- Post Entry - To process and save the transaction

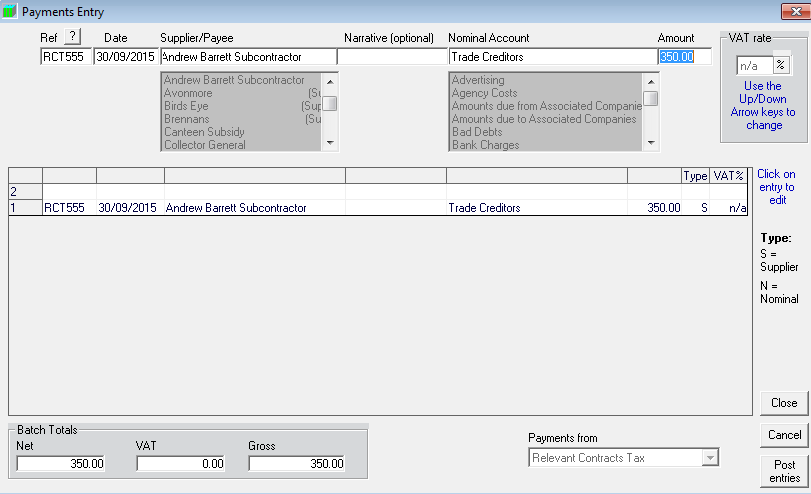

To record the 35% payable to the Revenue:

Bank > Payments

- Bank Account - Choose “Relevant Contracts Tax” as the Bank Account

- Reference - Enter an appropriate reference

- Date - Enter the date of payment

- Supplier Name - Select the Subcontractor name

- Nominal Account - This will default to “Trade Creditors” as the invoice has already

- been recorded as payable and is in Trade Creditors to be paid off

- Amount - Enter the remaining 35% payment figure

- Post Entry - To process and save the transaction

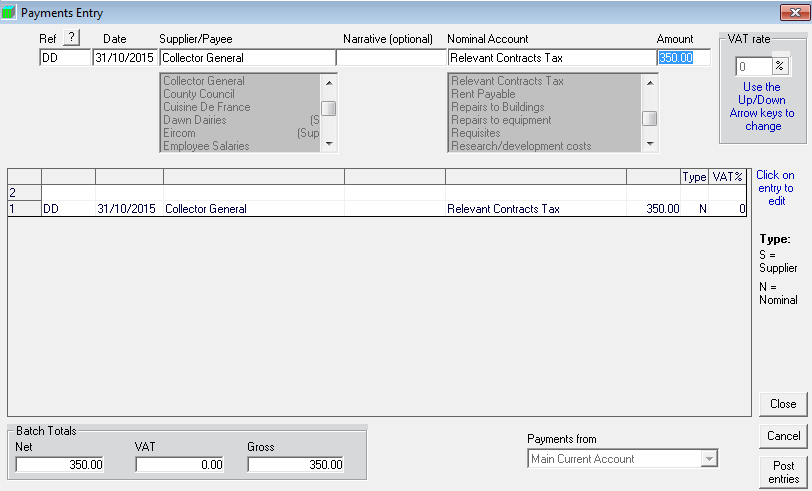

To subsequently record the actual monthly payment of any RCT withheld to Revenue:

Bank > Payments

- Bank Account - Choose the bank account you wish to make payment from

- Date - Enter the date of payment

- Reference - Enter a relevant payment reference

- Supplier/Payee Name - Choose “Collector General” as the Payee or leave blank

- Nominal Account - Select the “Relevant Contracts Tax” Nominal Account

- Amount - Enter the exact amount of the payment

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.