Principal Contractors & Reverse Charge VAT

A subcontractor no longer charges VAT to a Principal Contractor, where the charge on the invoice relates to a service subject to Relevant Contracts Tax in the Construction Industry. Instead the Principal Contractor is responsible for calculating the VAT on the amount charged by the Subcontractor and paying this directly to the Revenue through his/ her VAT Return.

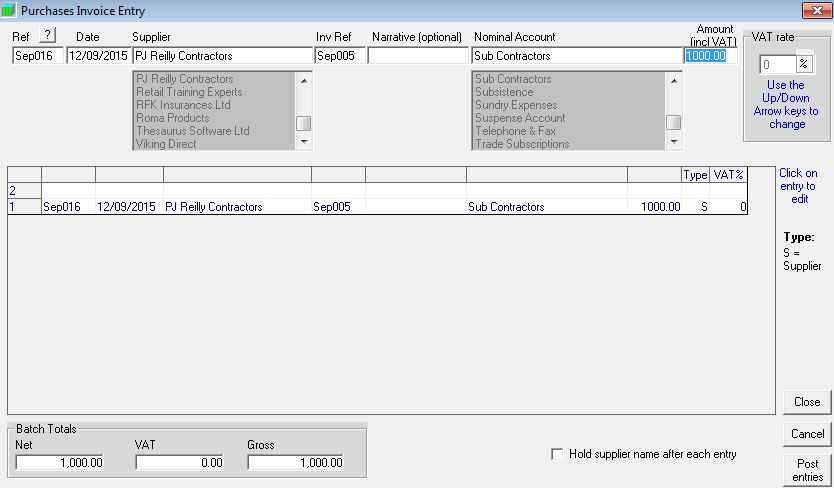

To post an invoice received from a Subcontractor:

Purchases > Batch Entry

- Reference - Your Purchase Invoice/ Credit Note Reference

- Date - Enter the date of the invoice

- Customer Name - Select/ Set up the Subcontractor

- Nominal Account - Select “Sub Contractors” as the Nominal Account

- Amount - Enter the invoice amount exclusive of any VAT

- VAT - Attach the 0% VAT rate by using the arrow up and down keys

To account for the VAT element relating to Subcontractor invoices you will first need to set up two new accounts:

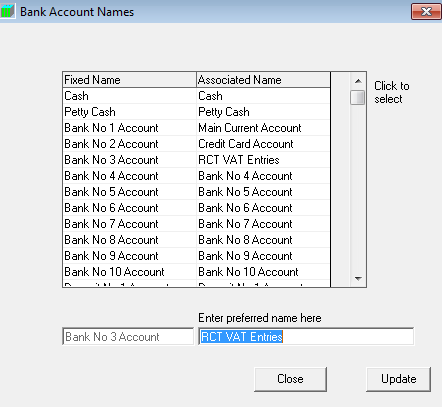

Set Up > Bank Account Names

- Rename an unused Bank Account as “RCT VAT Entries” and click on “Update”

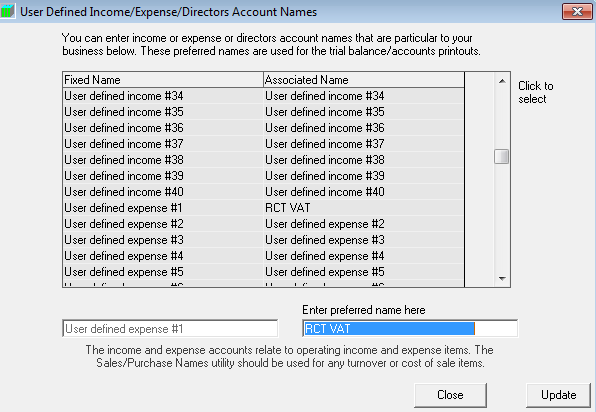

Set Up > User Defined Income/ Expenses

- Rename an unused Expense Account as “RCT VAT” and click on “Update”

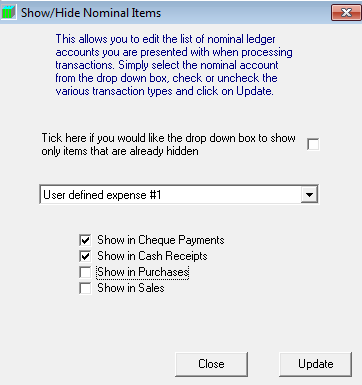

Set Up > Show/ Hide Nominal Accounts

- Select the 'User defined expense' that was renamed in the step above, tick to show in 'Cheque Payments' and 'Cash Receipts' and click on 'Update'

NB. The above only needs to be set up once.

To account for the VAT Payable on the Subcontractor invoice:

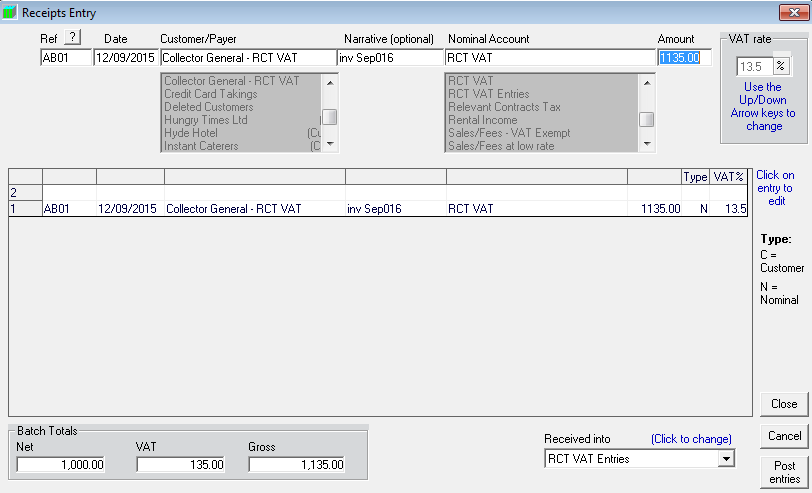

Bank > Receipts

- Bank Account - Choose “RCT VAT Entries” as the bank account

- Reference - Enter your internal reference

- Date - Enter the date shown on the invoice

- Customer/ Payer - Set up/ choose Collector General – RCT VAT as a Payer

- Narrative - Can be used to enter the Subcontractor’s name to which the entry relates

- Nominal Account - Choose “RCT VAT” as the Nominal Account

- Amount - Enter the VAT inclusive amount of the subcontractor invoice

- VAT - Attach the 13.5% VAT rate by using the arrow up and down arrows

To account for the VAT Reclaimable on the Subcontractor invoice:

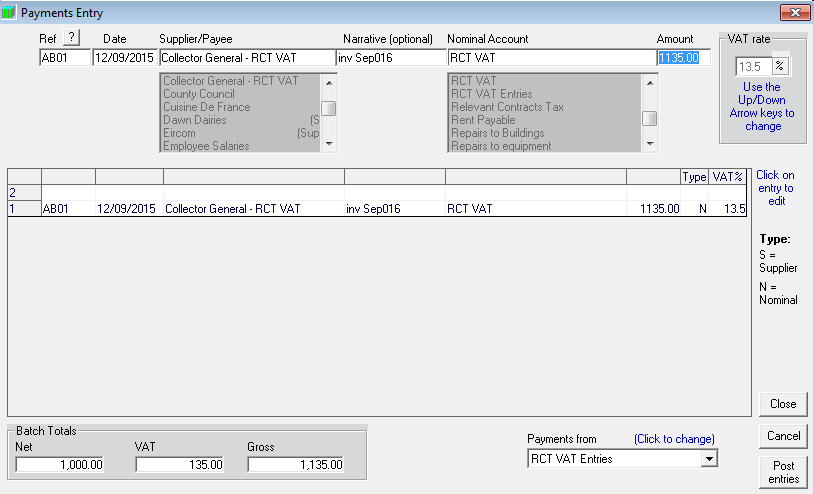

Bank > Payments

- Bank Account - Choose “RCT VAT Entries” as the bank account

- Reference - Enter your internal reference

- Date - Enter the date shown on the invoice

- Supplier/ Payer - Set up/ choose Collector General – RCT VAT as a Payee

- Narrative - Can be used to enter the Subcontractor’s name to which the entry relates

- Nominal Account - Choose “RCT VAT” as the Nominal Account

- Amount - Enter the VAT inclusive amount of the subcontractor invoice

- VAT - Attach the 13.5% VAT rate by using the up and down arrows

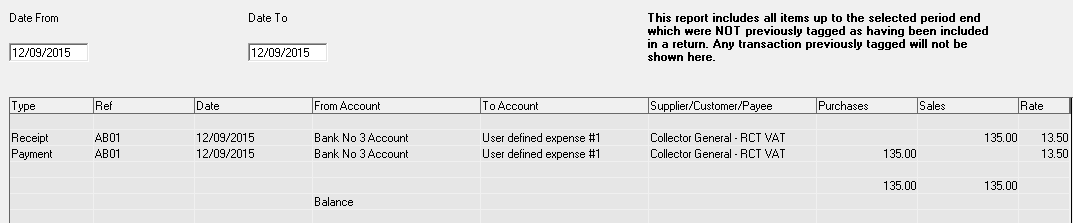

The VAT Report will now reflect the VAT amount applicable to the Subcontractor invoice as a reverse charge i.e. the VAT charge will be included in both the VAT on Sales total and the VAT on Purchases total:

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.