Accounting for EU Purchases

EU Intra Community Acquisitions

If you are VAT registered in Ireland you can buy goods VAT free from another business in the EU once these goods are for the purpose of your business. This is known as an EU intra community acquisition. The steps to be taken are as follows:

(1) Provide the supplier with your VAT number. They have to check that this is a valid VAT number. Once this is confirmed the supply will be made at a zero VAT rate in the country of supply.

(2) You become liable for the VAT on acquisition in Ireland. What this means is that you must account for it as a VAT on Sale (in the T1 section of the VAT return) at the rate of VAT you would sell the goods at.

(3) You are entitled to claim an input credit for the same amount in the VAT on Purchases on the VAT return (Box T2) This gives a NIL liability on the VAT return.

(4) When these goods are sold on, any future VAT on Sales must be accounted for in the normal way in your VAT return.

Accounting for EU VAT in Thesaurus Accounts isn’t an automated procedure and thus the following steps can be taken to satisfy 2 and 3 above:

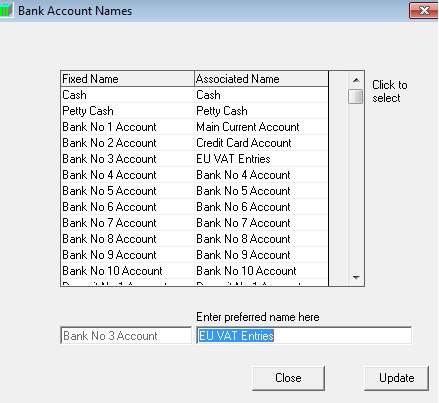

1. Go to Setup > Bank Account Names and rename an unused Bank Account as “EU VAT Entries”:

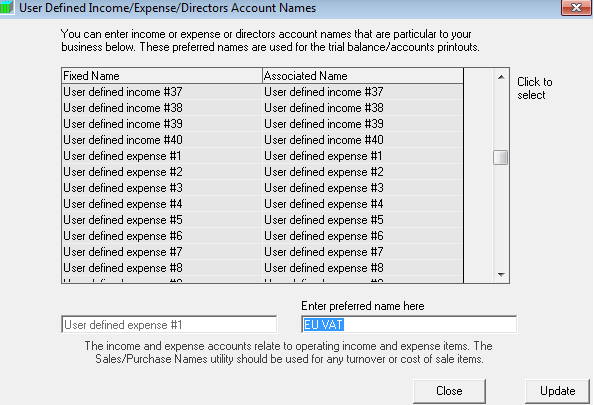

2. Go to Setup > User Defined Income/ Expenses and rename an unused Expense Account as “EU VAT”:

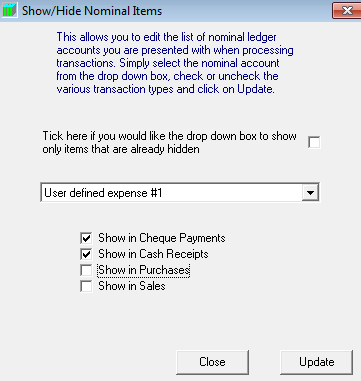

3. Next, go to ‘Setup > Show/ Hide Nominal Accounts’ and select the applicable user defined expense account that you have just renamed.

Tick to show in ‘Cheque Payments’ and ‘Cash Receipts’ and update:

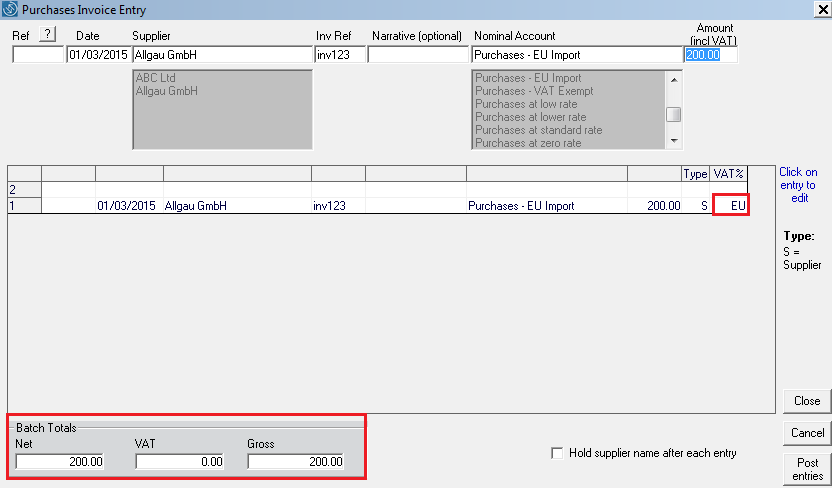

4. When an invoice is received from an EU Member State, enter and post in the normal way through Purchases > Batch Entry. A dedicated 'Purchases - EU Import' nominal account is preset in the software - this is will default to a zero-rated EU VAT rate:

5. To deal with the VAT element relating to the invoice, now complete the following two steps:

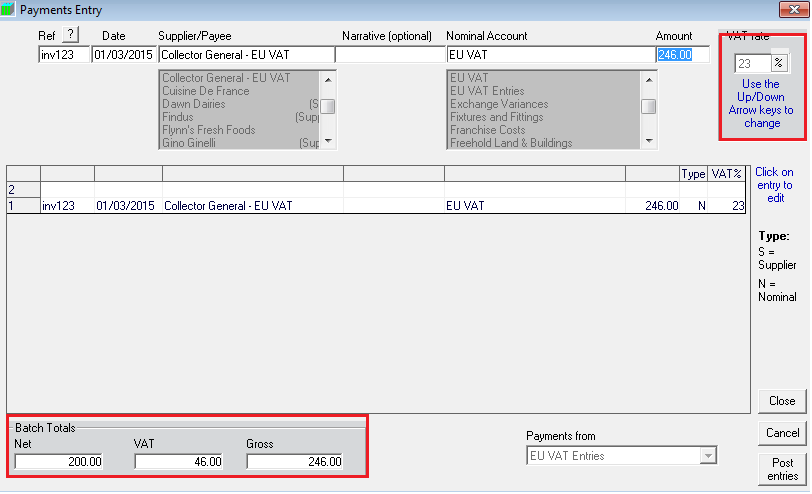

a)

- Go to Bank > Payments

- Choose “EU VAT Entries” as the bank account

- Reference and date can be the same as those used when posting the subcontractor invoice

- Set up “Collector General – EU VAT” as a Payee

- Choose “EU VAT“ as the Nominal Account

- Enter the VAT inclusive amount of the invoice and choose the VAT Rate that would be appropriate to the goods in ROI.

- Post the entry

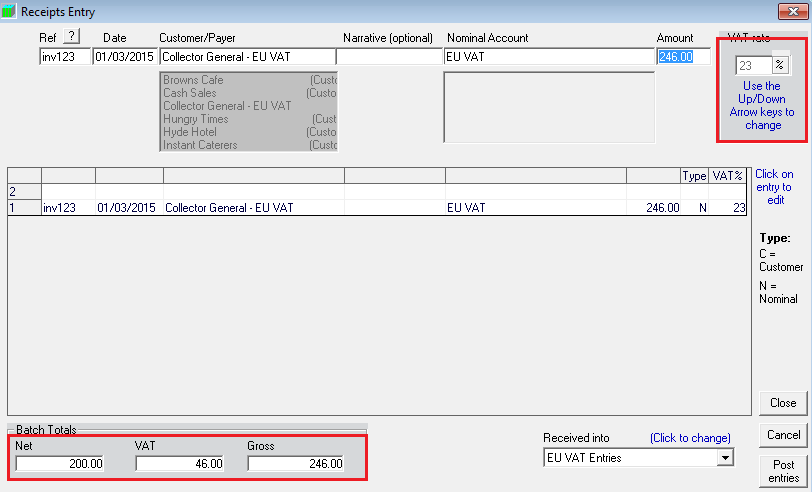

b)

- Go to Bank > Receipts

- Choose “EU VAT Entries” as the bank account

- Reference and date can be the same as those used when posting the subcontractor invoice

- Set up “Collector General – EU VAT” as a Payer

- Choose “EU VAT“ as the Nominal Account

- Enter the VAT inclusive amount of the invoice and choose the VAT Rate that would be appropriate to the goods in ROI.

- Post the entry

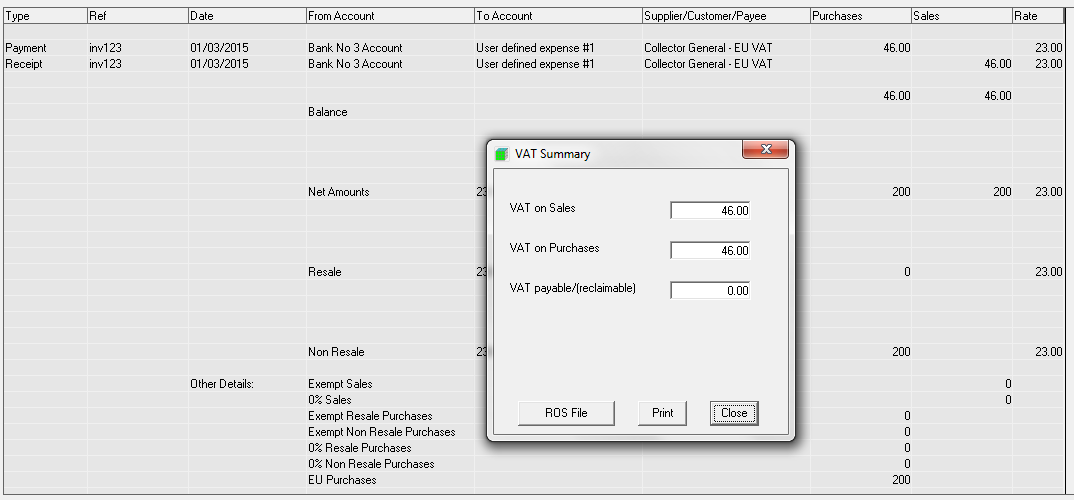

The VAT Report will now reflect the VAT amount appropriate to the EU invoice as a reverse charge (i.e. The VAT amount will be included in both the VAT on Sales total and the VAT on Purchases Total).

Going forward, simply repeat steps 4 and 5 for any future EU purchases.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.