Subcontractors & Reverse Charge VAT

A subcontractor no longer charges VAT to a Principal Contractor, where the charge on the invoice relates to a service subject to Relevant Contracts Tax in the Construction Industry. Instead the Principal Contractor is responsible for calculating the VAT on the amount charged by the Subcontractor and paying this directly to the Revenue through his/ her VAT Return.

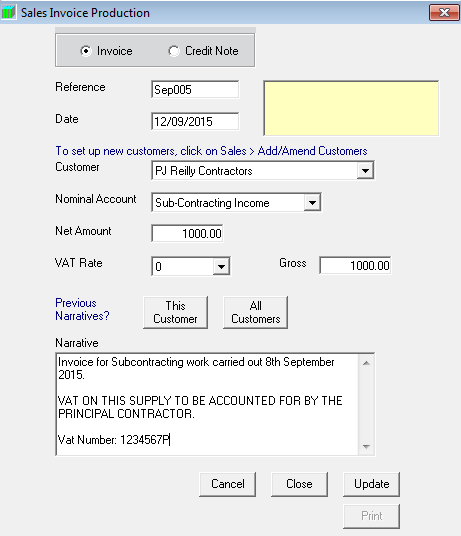

To raise an invoice for a Principal Contractor:

Sales > Invoice Production > Invoice/ Credit Note Entry

- Reference - Enter the relevant sales invoice reference

- Date - Enter the date of the invoice

- Customer Name - Select/ Set up the Principal Contractor

- Nominal Account - Select “Sub-Contracting Income” as the Nominal Account

- Amount - Enter the invoice amount exclusive of any VAT

- VAT - Attach the 0% VAT rate by using the arrow up and down keys

- Narrative - As well as any narrative of your choice, the invoice must include the statement:

“VAT ON THIS SUPPLY TO BE ACCOUNTED FOR BY THE PRINCIPAL SUBCONTRACTOR”.

(NB. The invoice must also include your VAT registered number)

NB. With agreement from both parties, the Principal Contractor can raise the invoice themselves on behalf of the Subcontractor. Should this be the case, the transaction will still need to be entered in Thesaurus Accounts, as above, or through the Sales > Batch Entry screen.

Need help? Support is available at 01 8352074 or thesauruspayrollsupport@brightsg.com.